Options trading is an advanced investment approach that can help diversify your portfolio, manage risk, and potentially increase profits. By understanding how to use the most successful options strategy in India , you can take advantage of the flexibility and leverage they offer. This blog will guide you through the basics, benefits, and strategies of options trading, providing you with the knowledge needed to enhance your trading success.

Table of Contents

1. Understanding Options

Options are financial derivatives that give you the right, but not the obligation, to buy or sell an asset at a predetermined price before or on a specific date. There are two main types of options: calls and puts.

A. Call Options: Give the holder the right to buy an asset at a set price.

B. Put Options: Give the holder the right to sell an asset at a set price.

2. Benefits of Using Options in Your Trading Strategy

Incorporating options into your trading strategy offers several advantages:

A. Leverage: Options allow you to control a large number of shares with a relatively small investment, amplifying potential returns.

B. Risk Management: Options can be used to hedge against potential losses in your portfolio, providing insurance for your investments.

C. Flexibility: Options provide various strategic opportunities, such as bullish, bearish, or neutral market positions.

D. Income Generation: Writing options can generate additional income through premiums received from selling options contracts.

3. Popular Options Strategies

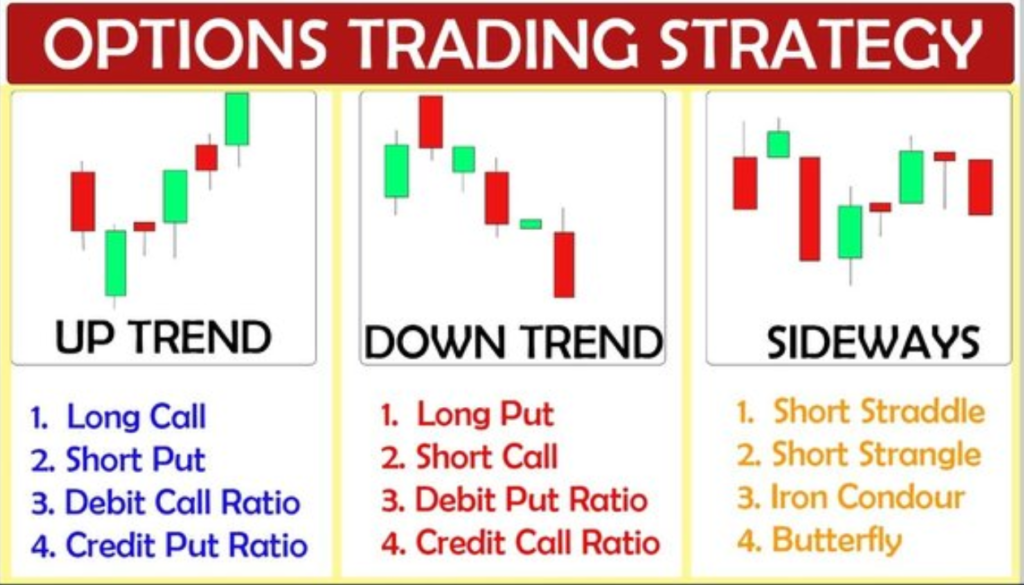

Here are some common options strategies that traders use:

A. Covered Call

A covered call involves holding a long position in a stock while selling a call option on the same stock. This strategy generates income through the premium received from selling the call option while providing some downside protection.

When to Use: When you have a neutral to slightly bullish outlook on the stock.

Example: You own 100 shares of XYZ stock at $50 per share and sell a call option with a strike price of $55, expiring in one month, for a premium of $2 per share.

B. Protective Put

A protective put involves buying a put option for a stock you already own. This strategy acts as an insurance policy, limiting potential losses if the stock price drops.

When to Use: When you have a long position in a stock and want to protect against downside risk.

Example: You own 100 shares of ABC stock at $60 per share and buy a put option with a strike price of $55, expiring in two months, for a premium of $3 per share.

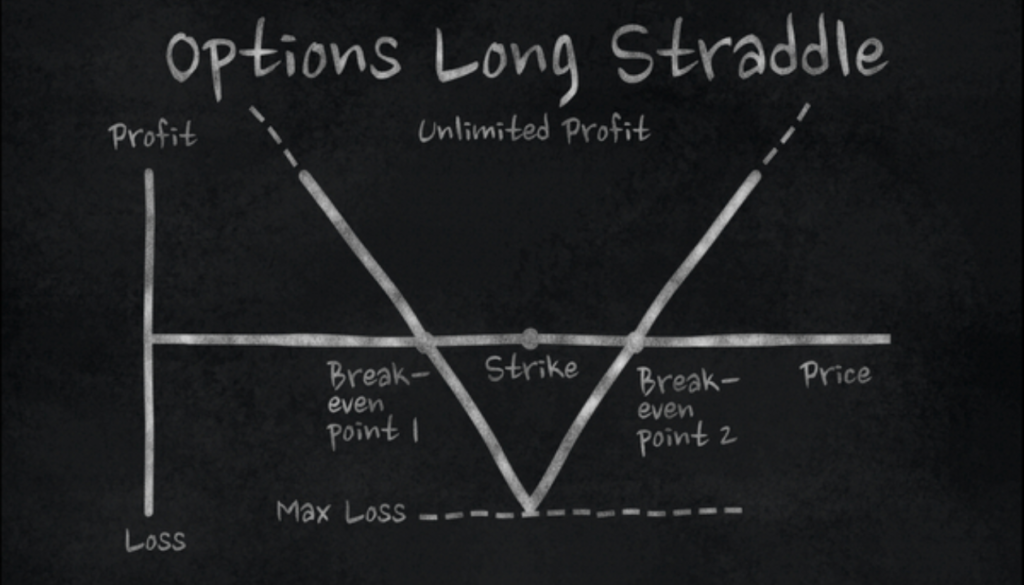

C. Straddle

A straddle involves buying both a call option and a put option with the same strike price and expiration date. This strategy profits from significant price movements in either direction.

When to Use: When you expect a large price movement but are unsure of the direction.

Example: You buy a call option and a put option for DEF stock, both with a strike price of $70 and expiring in three months, for premiums of $4 and $3 per share, respectively.

D. Iron Condor

An iron condor involves selling a lower strike put, buying a higher strike put, selling a higher strike call, and buying an even higher strike call. This strategy profits from low volatility and small price movements.

When to Use: When you expect the stock price to remain stable within a certain range.

Example: You sell a put option with a strike price of $45, buy a put option with a strike price of $40, sell a call option with a strike price of $55, and buy a call option with a strike price of $60, all expiring in one month.

Read More :- How the Stock Market Works in India: A Comprehensive Guide, The Importance of Fundamental Analysis in Stock Trading

E. Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and selling a call option at a higher strike price. This strategy profits from a moderate rise in the stock price.

When to Use: When you have a moderately bullish outlook on the stock.

Example: You buy a call option for GHI stock with a strike price of $50 and sell a call option with a strike price of $60, both expiring in two months, for premiums of $5 and $2 per share, respectively.

4. Tips for Using Options in Your Trading Strategy

A. Understand the Basics: Before diving into options trading, ensure you have a solid understanding of the fundamentals and the mechanics of options.

B. Start Small: Begin with simple strategies and gradually move to more complex ones as you gain experience.

C. Use Risk Management: Always have a risk management plan in place to protect your investments.

D. Stay Informed: Keep up with market news and trends that can impact your options positions.

E. Practice with Paper Trading: Use paper trading accounts to practice your strategies without risking real money.

By incorporating these strategies and tips, you can effectively use options in your trading strategy, enhancing your potential for success and profitability.

Frequently Asked Questions

1. What are options in trading?

Ans. Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price before or on a specific date.

2. How can options be used for risk management?

Ans. Options can be used to hedge against potential losses by providing insurance for your investments, such as using protective puts to limit downside risk.

3. What is a covered call strategy?

Ans. A covered call involves holding a long position in a stock while selling a call option on the same stock to generate income through the premium received from selling the call option.

4. When should I use a straddle strategy?

Ans. A straddle strategy is used when you expect a large price movement in the stock but are unsure of the direction, allowing you to profit from significant price movements either way.

5. What are the benefits of using options in trading?

Ans. Benefits of using options in trading include leverage, risk management, flexibility, and income generation through premiums received from selling options contracts.