Online trading platforms like Groww and Zerodha have made investing in the stock market very easy. People can now easily invest their money through online platforms without following cumbersome procedures or engaging expensive agents. But with so many options available to you, you wonder which is the best platform for you. In this blog, we will do a comparison of two of India’s most popular trading platforms—Groww vs Zerodha —to help you make a better decision.

Table of Contents

1. Introduction to Groww vs Zerodha

Compare both before jumping into the comparison; let’s get to know both platforms a little better.

Zerodha: After its incorporation in 2010, Zerodha is usually credited with changing the way people invest in the Indian stock market. It was among the pioneering discount brokers in India who introduced low brokerage fees with an easy and clean user interface. Zerodha’s mission has always been to make trading very affordable and accessible to all people.

Groww: Incorporated in 2016, Groww initially started as an investment platform for mutual funds. Gradually, it increased its offerings to include stocks, gold, and other investment products. Groww rose to fame with this clean and intuitive interface that makes it highly user-friendly, especially for first-time investors.

Now that we have introduced the players, let us proceed with the comparison.

2. User Interface and Experience

UI and UX for any platform are viewed to be of paramount importance in an online trading realm. A good UI should be easy to use while navigating, and the UX should make the act of investment hassle-free.

Zerodha: The platform of Zerodha, Kite, has a very minimalistic design. All is neat, with easy access to market watch, orders, positions, and holdings. Still, it might overwhelm certain people, mainly those who use it for the first time. The platform comes filled with advanced tools and charts that more suit experienced traders.

Groww: Groww has been kept simple. The interface is sleek, modern, and very user-friendly. It is designed to attract people who are new and has straightforward navigation with a focus on making the investing process as simple as possible. If you’re new to investing, you’ll likely find Groww more user-friendly.

3. Brokerage Charges and Fees

Cost is a thoughtful parameter when looking for a trading platform. Higher fees would mean reducing your profit margin, so certainly consider the brokerage and other related charges that each platform might incur.

Zerodha: The discount brokerage model of Zerodha charges you ₹20 or 0.03 percent for all executed equity intraday trades and F&O (Futures & Options) trades for every executed order, whichever is less. Zerodha does not charge any brokerage for equity delivery, which is supremely good news for long-term investors. However, other charges include the Demat account maintenance charge, transaction charge, and taxes to be paid to the government.

Groww: Groww, on its part, is also a discount brokerage platform, being relatively new in the stock trading space. It charges ₹20 or 0.05% per executed order, whichever is lower, for intraday and F&O trades. For equity delivery trades too, Groww charges no brokerage. Like Zerodha, Groww also there are additional charges for account maintenance and government taxes.

4. Range of Investment Options

One will be attracted to his interest in the variety of investment options one platform has over another, if he wants to diversify his portfolio.

Zerodha: This offers a variety of investment options from stocks to mutual funds, bonds, government securities, to commodities, and further allows one to trade even more complex products that include options and futures. Also, Zerodha’s Coin offers the scope to invest in direct mutual funds at no added commission.

Groww: Groww began with mutual funds and has since spanned stock, ETFs (Exchange-Traded Funds), and gold investment. Though Groww offers a good investment range, it cannot compete with Zerodha when it is about a number of choices, particularly on the advanced trading products like commodities or futures and options.

5. Research and Analytical Tools

Quality of investment depends on robust research and analysis tools for decision-making value. Let’s see how the same fairs with both Zerodha and Groww.

Zerodha: Known for its powerful research and analytical tools, Zerodha supports a plethora of charts with detailed observations and technical analysis tools that are highly useful for the trader. Its learning platform, Varsity, provides educational content on trading and investing. While using Zerodha’s Kite platform, additional tools from most third-party apps, like Sensibull and Streak, are supported for seasoned traders.

Groww: on the other hand, is more focused on simplicity. It thus provides only basic charts and some analysis tools, sufficient for a beginner or casual investor but definitely not as in-depth as Zerodha. Groww does have a blog and a few educational pieces, but again, it isn’t as detailed as what can be found at Zerodha.

Read More :- Understanding Zerodha: A Comprehensive Guide in Simple Terms

6. Customer Support

Good customer support can be a savior when things go wrong or when questions arise.

Zerodha: In their back, Zerodha avails customer support through e-mail, phone services, and even a support ticketing system, though many users feel that the response provided by it is slow enough during peak hours. It has a help section on its official website that is well detailed and offers support across a wide variety of issues.

Customer Care: Groww offers customer service through chat, email, and over the phone. One of the strengths for Groww is its responsive customer support team. Many users, most of the time, praise the platform due to the quick and helpful responses on the advice asked on different things. Groww also has a very detailed FAQ section on its website.

7. Mobile App Experience

In today’s fast-moving world, a good mobile app experience has become essential in terms of on-the-go trading and investing.

Zerodha: Kite mobile, developed by Zerodha, has a high rating on performance and features. It enables nearly all the features of the web platform, such as advanced charting, placing orders, and market analysis on the go. Many users, however, have said that it may be a bit confusing for beginners.

Groww: Groww has specifically designed its mobile application to be simple in nature. It is easy to use, clean in UI, and beautiful for first-time investors. It focuses on having a smooth user experience without Fang alongside the user due to too many features. Hence, it does lack some advanced tools that advanced traders might want.

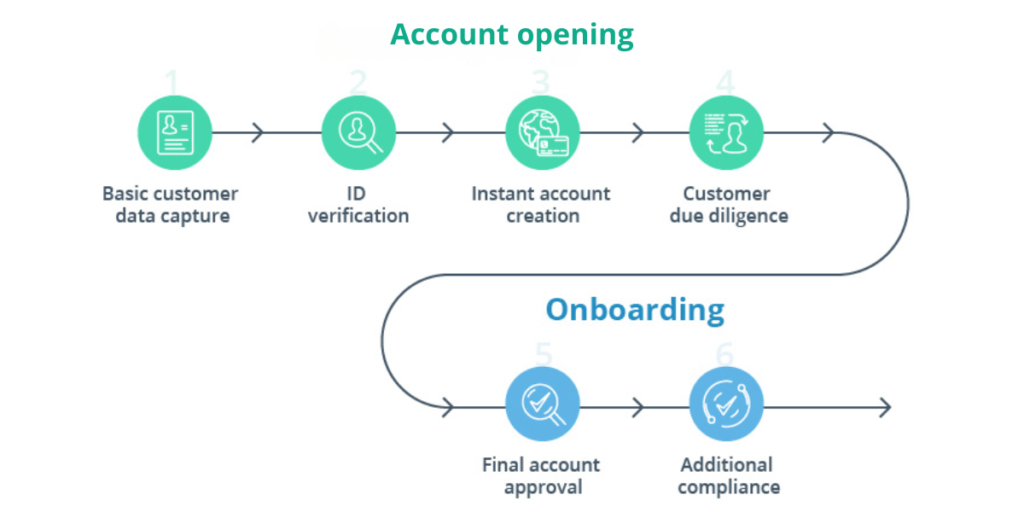

8. Account Opening Process

The ease of opening an account might be one of the deciding factors, especially if you are a new investor.

Zerodha: While the whole account opening process in Zerodha is online, it is somewhat hectic. There are tons of documents required to be submitted, and it may take a couple of days or more before your account becomes fully functional. However, Zerodha provides detailed instructions to help you through the process.

Groww: Groww’s account opening process is also online and quick. It is pretty simple, easy, and self-explanatory. It has been made hassle-free as much as possible so that even beginners can start investing easily. Most users do it in a few hours.

Read More :- Mutual Fund 101: What Every Investor Should Know

Conclusion: Which is Better?

So, Zerodha or Groww—which is better? The answer depends on your needs and preference.

Use Zerodha only if you are an advanced trader who needs advanced tools and products, along with low brokerage fees on intraday and F&O trades. With the depth of research tools and quantum of education-oriented content, Zerodha is an excellent platform for serious traders.Go for Groww if you are an amateur investor or a casual investor looking at ease of use, simplicity, and speed in opening an account as the most important traits. With its ease of use, intuitive interface, and responsive customer support, Groww presents a superb solution for those embarking on their journey of ‘Investing 101’.

Eventually, what works well in both these platforms depends on the most important priority to an individual. Choose Zerodha or Groww; what matters is starting your investment journey with confidence. Happy investing!