As one enters the world of investment, common jargon often heard includes ETFs in stock trading. But with the rise in popularity, what exactly are these ETFs? In this post, we take a look at what an ETF is, the benefits derived from them, and how this can be used as a powerful tool for diversification in your stock portfolio.

Table of Contents

1. What Are ETFs in Stock Trading?

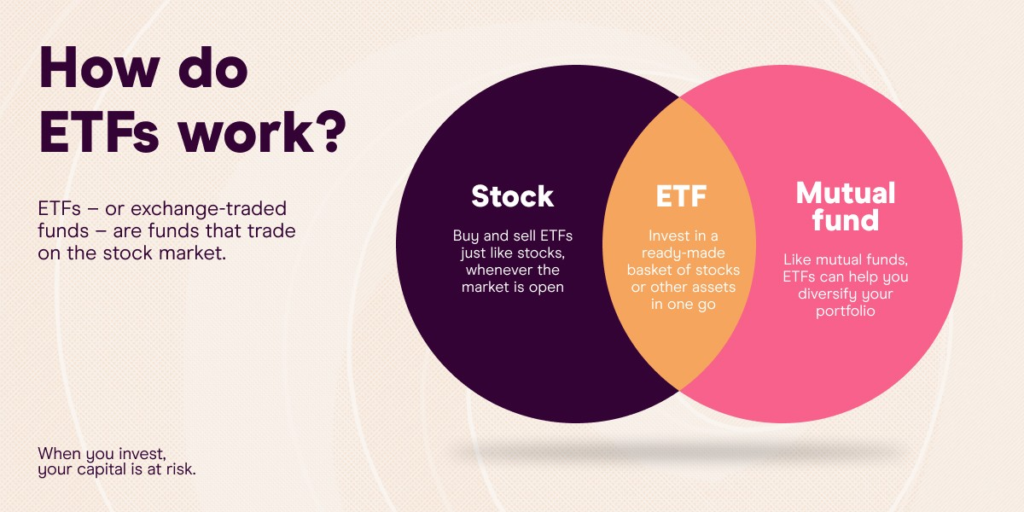

An ETF, or Exchange-Traded Fund, is a traded financial instrument that follows the performance of specific assets or markets; it can be traded on the stock exchange like single stocks. But an ETF is unlike a single stock in that it holds, within itself, a collection of many types of assets, such as stocks, bonds, or commodities, that give investors broad exposure to different markets. An investment in an ETF is basically a small chunk of a bigger investment basket.

An example could be that of an ETF that tracks the S&P 500 index. The moment you purchase one share of such an ETF, you indirectly invest in 500 companies that constitute the S&P 500. And the fundamental behind investment is: you are not putting your money into one company, you are spreading it within many companies, and that is what is called diversification.

2. Why Stock Trading Matters in Diversification

We will come closer to the role of an ETF in stock trading later; for now, let’s try to understand why diversification is so crucially important. Diversification is such a practice when one spreads investments across a wide range of assets. The main idea of this concept is similar to not putting all of your eggs in one basket. If you put all your money into one stock and that company does poorly, you risk losing a large share of your investment. But the moment you spread that across a number of stocks, it lessens the impact of one not turning out quite so great.

Most importantly, with regard to stock trading, ETFs can be a very simple way of attaining diversification. Instead of stressing about the selection of particular stocks, an investor can just get exposure to the ETFs holding a range of stocks to reduce specific company exposure. This means that when one company performs badly, the positive performance of other companies in the ETF balances out the overall investment.

3. How Do ETFs in Stock Trading Help with Diversification?

ETFs in stock trading can aid an investor in the diversification of a portfolio in several ways. Some ways include:

A. Market Exposure: ETFs are pretty convenient in terms of broad exposures to various markets. For example, when investing in an ETF, by default, there is an indirect investment in the broad market index such as S&P 500, and hence an indirect investment in hundreds of companies spread across different industries. This is supposed to be useful in general, as it ensures the risk reduction discrete to investing in individual stocks.

B. Sector and Industry Diversification: Not all ETFs track broad market indices. Some ETFs follow specific sectors like technology, healthcare, or finance. In this way, investing in sector-specific ETFs exposes one to a certain industry without the hassle of picking and choosing individual stocks. This also lets you take a bet on an entire sector growing, as opposed to betting on only one company.

C. Geographical Diversification: Another positive aspect of ETFs over stocks is their ability to be invested in geographical diversification. Given that many ETFs cover international markets, an investor who wishes to invest internationally will be afforded the opportunity to get into those, and that will reduce geographical exposure overloaded on one country’s portion. Suppose you think that the markets in China or India are going to blow up in the coming years; one could invest in an ETF which tracks them. It helps to spread risk, especially if parts of the world are performing differently from others.

D. Diversify Across Asset Classes: ETFs needn’t be exclusively about equities-there are bond, commodity, or real estate ETFs. Diversification across asset types spreads risk even further. Bonds are well recognized for exhibiting performance typical of a different asset class than equities. Thus, a portfolio that includes both should balance those investments in various market conditions.

4. Advantages of Using ETFs in Stock Trading

Having ascertained how the ETFs help in diversification, some other benefits of ETFs in stock trading include the following:

A. Cost-Effectiveness: One of the most attractive aspects of all in ETFs is cost-effectiveness. The majority of the ETFs have lower expense ratios compared to mutual funds; hence, you pay fewer dollars in management fees. Lower fees can make a big difference over time, especially to a long-term investor.

B. Liquidity: Unlike mutual funds, which can only be bought or sold at the end of the trading day, ETFs trade throughout the day on either of the stock exchanges. That means you can buy and sell at any moment during market hours, having more leeway and control over your investment.

C. Transparency: Transparency is one major reason most people love and trust ETFs. Most of them disclose their holdings daily, so you will always know what you invest in. This level of transparency could be very comforting, especially to those investors who want to monitor their portfolio’s performance very closely.

D. Accessibility: This is the one aspect where buying an ETF has never been easier with the rise of online brokerage platforms. Furthermore, most brokers will not charge for commissions on their ETFs; thus, it is a low-overhead avenue to enter into, both for the novice and seasoned investor alike.

Read More :- Common Stock Market Mistakes and How to Avoid Them

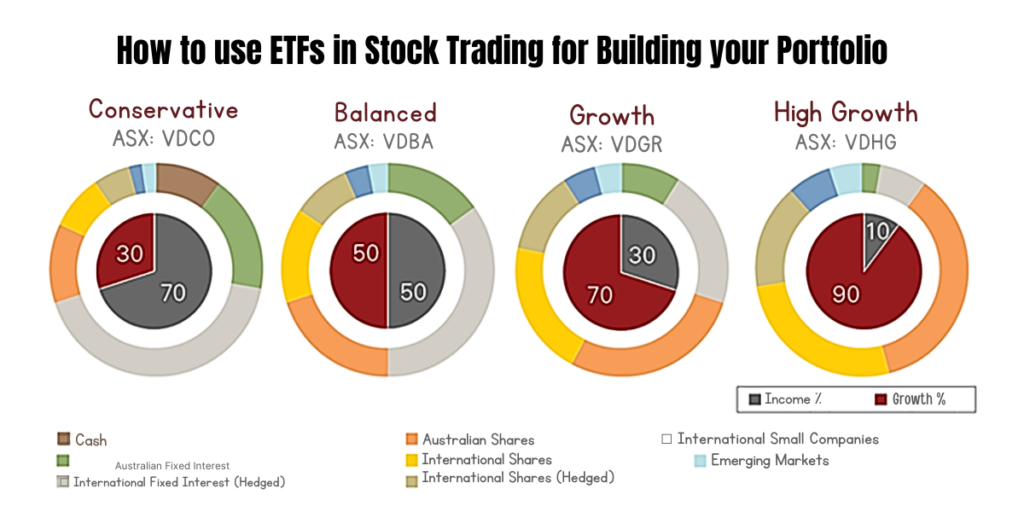

5. How to use ETFs in Stock Trading for Building your Portfolio

If you want to know how to build a diversified portfolio through the use of an ETF in stock trading, then here are a few strategies:

A. Core Portfolio Holding: Many investors utilize broad-based market ETFs at the core of their portfolios. For example, it could be a simple ETF tracking the S&P 500 or the MSCI World Index. These are good backbones owing to the vast exposure the investor will get to companies and industries alike.

B. Thematic Investing: You could also use ETFs to reach a certain investment theme or trend that you might have in mind. Suppose you’re interested in technology or clean energy; well, there are different ETFs for each of those industries. It lets you invest in themes that fascinate you while still gaining diversification.

C. Balancing out the risk: With a proper mix of everything in it—stocks, bonds, commodities—an investor would be able to balance out the risk while improving potential returns. For instance, if you think the stock market is overvalued, you might be attracted to putting a greater part of your portfolio in bond or commodity ETFs, among others.

D. Geographic Diversification: Invest in those ETFs tracking international indices or focused on specific regions that can help in diversifying away from their home market. Such geographic allocations spread out the risks and take advantage of growth opportunities in different parts of the world.

6. Knowing the Risks of Trading Stock with ETFs

Even with the many advantages of trading stock with ETFs, there are risks also associated with the process:

A. Market Risk: Like every other investment, an ETF is therefore commission-bearing and market risks are no exception. If the market experiences a decline, then it will sell at a low price and, chances are, that the value of your ETF will also experience a similar situation.

B. Tracking Error: The difference exists because all the ETFs do not replicate exactly the market index or benchmark that they are supposed to represent; this error in tracking then quantifies the return differences between an ETF and its underlying index.

C. Liquidity Risk: While most ETFs are highly liquid, those with low trading volumes lead to greater difficulty when one wishes to buy or sell them at a desired price.

D. Concentration Risk: Not with standing, it is worth noting that with diversification benefits, some ETFs might be having very heavy concentrations to some specific sectors or companies. In making sure that diversification goals are met, it is prudent to check the holdings of the ETF.

Read More :- Master Swing Trading: Essential Strategies and Stocks

Conclusion

ETFs in stock trading have brought huge revolution in the way people invest, giving a simple and cost-effective method of diversifying one’s portfolio and managing the risk. Be it one with some experience on investments or just starting, ETF investments nicely fit into your game, giving good market exposure and diversification within sectors and geographies, including asset classes. That said, doing your research in understanding the risks and matching available ETFs to your financial objectives should also apply. Happy investing!