From the time that technology gained momentum, the face of algo trading in the financial world has seen a lot of change. Gone are the days when trading was solely carried out by floor brokers who shout their orders across a noisy stock exchange. A huge chunk of the trading these days is carried out through algorithms, which are actually complex sets of instructions that can make decisions to execute trades at superhuman speeds. Such a process is called algo trading, also known as “algo trading,” and it revolutionized the financial markets.

But what exactly is algo trading? How does it work? Well, most essentially, why has it taken the world by storm? The following blog is an attempt to break algo trading into very basics, put them into simpler language, see how it works, followed by how you can proceed in case you are tempted.

Table of Contents

1. Understanding the Basics of Algor Trading

A. What is Algorithmic Trading?

Algorithmic trading involves the use of computer programs in executing and automating the process of trading financial assets, such as stocks, bonds, or even currencies. These algorithms could be set to follow certain instructions, like timing, price, and volume, in conducting trades that either maximize profits or decrease risks.

B. Why Algorithmic Trading Matters:

It is important because it enables trades to execute at a much quicker pace and more efficiently than what a human would be capable of. Algorithms are able to make decisions void of human emotion and error in the trading process, based purely on data and set-out criteria in advance, which potentially can mean better trading outcomes.

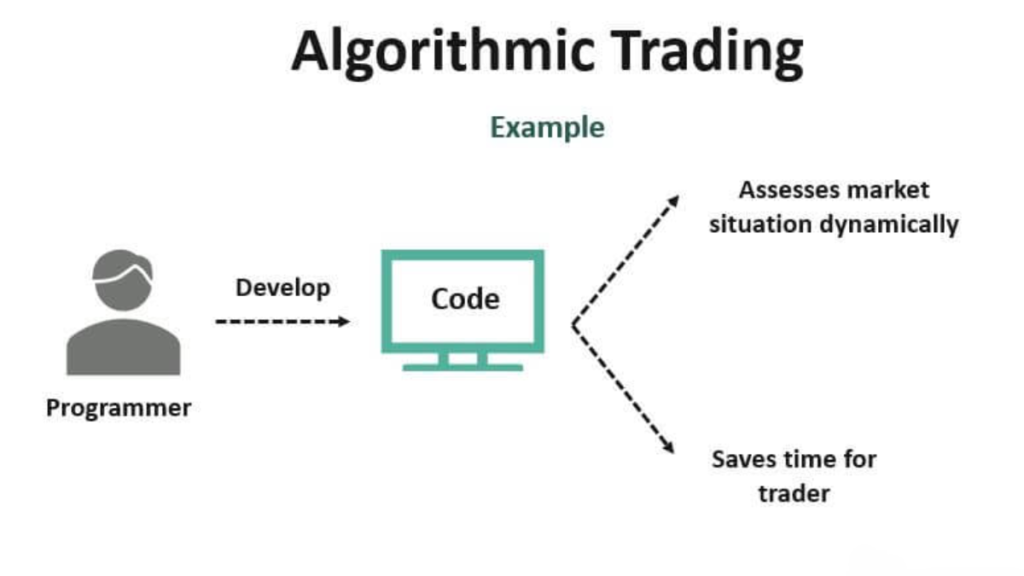

C. Real-World Example

Say you want to invest in stock, but only when the price goes down to a specific level. This means that instead of wasting your time relentlessly monitoring the stock price, an algorithm can do it for you and automatically place a buy order when your criteria are met. Not only is this a time-saving approach, but due to human delay, you also avoid missing out on an opportunity.

2. How Algo Trading Works

A. Market Mechanics

At the very basic level, an algorithmic trading system relies on the integration of a few key components:

Data Input: Algorithms feed on data. This may be historical price data, news feeds, social media sentiment, and so on.

Strategy Development: The trader or, rather, the developer defines strategies to be followed by algorithms. Strategies can be rule-based, based on technical indicators, or even statistical models or machine learning.

Execution: This algorithm executes the trade as soon as the conditions set in the strategy are met. This typically happens in milliseconds. Types of Algorithmic Trading There are types of algorithmic trading, each having its own style, including: Trend-Following Algorithms: Such algorithms attempt to surf the waves of the trend of the markets by identifying and following an upward or downward movement in asset prices.

Arbitrage algorithms: These are designed to exploit price discrepancies across different markets or instruments by buying low in one and selling high in another, which is performed in seconds. If the prices of assets are strongly mean reverting, these algorithms will take advantage of this by buying that asset when it’s undervalued and selling it when overvalued.

Market-Making Algorithms: The algorithms continuously quote prices of buy and sell for an asset, profiting on the bid-ask spread. Tools and Platforms Algorithmic trading requires usage of special platforms for strategy development, back testing the strategies on historical data, real-time data feeds, and trade execution in the markets. Some popular platforms include Meta Trader, Ninja Trader, and custom-built software developed in a programming language—like Python or R.

Read More:- Long-Term Investing: A Strategic Path to Financial Growth, Master Swing Trading: Essential Strategies and Stocks

3. Key Strategies and Techniques in Algorithmic Trading

A. Fundamental Analysis in Algo Trading

The very concept of algorithmic trading puts it under the umbrella of technical analysis; however, it can also include quite a few fundamental analysis techniques. For example, the algorithm could look through news stories or earnings reports to gauge sentiment on a stock and then make the appropriate trading decisions.

B. Technical Analysis and Indicators

Technical analysis comes as a major constituent of algo trading. This involves algorithms using technical indicators, Moving Averages, Relative Strength Index, Bollinger Bands, to name but a few, in determining trading opportunities. An algorithm would be instructed to buy, for example, when the RSI reads less than 30, thus having reached an oversold position.

C. Risk Management

One of the most important parameters of algorithmic trading could be risk management. Algorithms can be set to automatically place stop-loss orders so that trades are automatically closed out in case the markets turn against the trader beyond a certain point. This saves the trader from big losses and preserves his capital.

4. Common Mistakes in Algo Trading and How to Avoid Them

A. Strategies for Over-Optimization

Overfitting strategies during the back testing phase is one of the most frequent mistakes in algo trading. This involves fitting the strategy so well to the past data; it does great in the back test but then fails in the live markets. One cannot avoid this but by testing the strategy on out-of-sample data and keeping the strategies simple.

B. Market Impact Ignored

Another mistake is not accounting for the market impact of large trades. In other words, if an algorithm is designed to buy or sell thousands of shares, it can move the market and end up getting less desirable prices. To avoid this, one has to consider algorithms that execute orders in smaller pieces over time.

C. Emotional Trading

Even with an automated system in place, the urge to turn interventionist may overcome one; more so in times of volatility. It mostly results in poor decisions. Hence, it is very important to trust the algorithm and stay the course of the plan. Emotions normally lead to irrational choices.

5. Tools and Resources for Aspiring Algo Traders

A. Educational Resources

If you’re new to algorithmic trading, there are plenty of resources to help you learn. Websites like Investopedia, Coursera, and Khan Academy offer courses on trading and financial markets. Additionally, books like “Algo Trading: Winning Strategies and Their Rationale” by Ernest P. Chan can provide a solid foundation.

B. Trading Platforms

Choosing the right platform is key to successful algo trading. For beginners, platforms like Meta Trader 4/5 and Trading View offer user-friendly interfaces and support for algorithmic trading. For more advanced users, developing custom algorithms using Python on platforms like Quant Connect or Interactive Brokers is a common approach.

Conclusion

Algorithmic trading has evolved into a robust tool in the armory of any modern trader. By automating the trading process, it enhances efficiency and potentially profitability through technology, data, and advanced strategies. It’s not all fun and games, however. Overfitting strategies, ignoring market impact, and giving in to your emotions—all these can lead to less-than-desired results.