Investing in the stock market can be a lucrative way to grow your wealth, but it also comes with its challenges. Many investors, both new and experienced, make common mistakes that can hinder their success. Understanding these mistakes and learning how to avoid them is crucial for improving your investment performance and achieving your financial goals. In this article, we will explore some of the most common stock market mistakes and provide strategies to help you avoid them.

Table of Contents

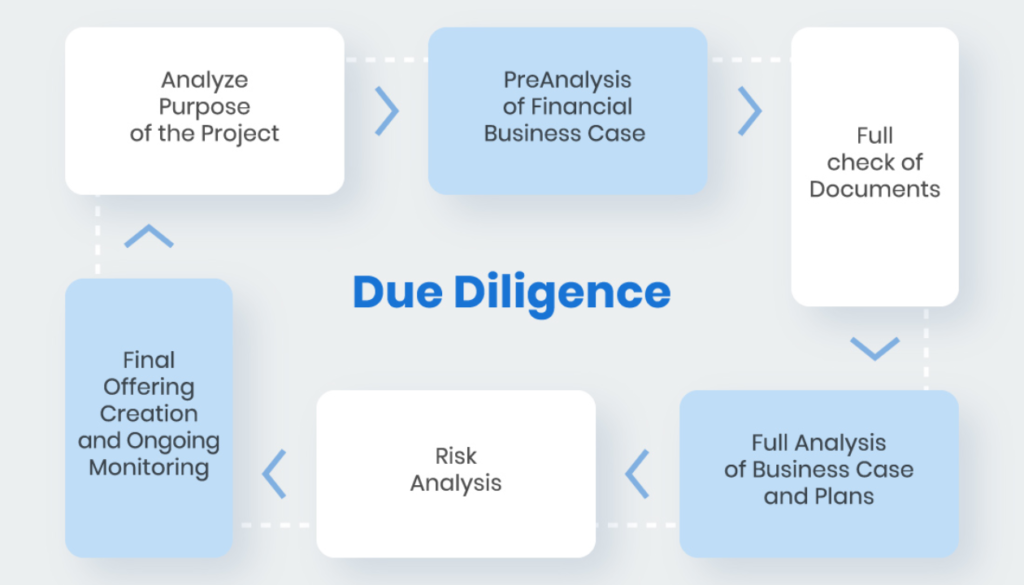

1. Lack of Research and Due Diligence

One of the biggest mistakes investors make is not conducting thorough research before making investment decisions. Relying on tips, rumors, or gut feelings without proper analysis can lead to poor investment choices.

How to Avoid:

A. Do Your Homework: Take the time to research companies, understand their financials, business models, and industry trends.

B. Use Reliable Sources: Rely on reputable financial news sources, analyst reports, and company filings to gather information.

C. Understand the Market: Stay informed about broader market trends and economic indicators that can impact your investments.

2. Emotional Trading

Emotional trading is a common pitfall that can lead to impulsive decisions and significant losses. Fear and greed are powerful emotions that can cause investors to buy high and sell low.

How to Avoid:

A. Stick to a Plan: Develop a clear investment strategy and stick to it, regardless of market fluctuations.

B. Set Realistic Goals: Establish realistic profit targets and stop-loss levels to manage your emotions and avoid panic selling.

C. Stay Disciplined: Avoid making decisions based on short-term market movements or news headlines.

3. Overtrading

Overtrading, or excessive buying and selling of stocks, can lead to high transaction costs and lower overall returns. Frequent trading can also increase the likelihood of making poor investment decisions.

How to Avoid:

A. Adopt a Long-Term Perspective: Focus on long-term investments rather than trying to time the market.

B. Minimize Transactions: Limit the number of trades you make to reduce transaction costs and avoid the temptation to overtrade.

C. Review Performance Periodically: Instead of constantly monitoring your portfolio, review its performance periodically to make informed adjustments.

4. Ignoring Diversification

Putting all your money into a single stock or a few stocks can expose you to significant risk. Lack of diversification can lead to substantial losses if those investments underperform.

How to Avoid:

A. Diversify Your Portfolio: Spread your investments across different sectors, industries, and asset classes to reduce risk.

B. Use ETFs and Mutual Funds: Consider investing in exchange-traded funds (ETFs) and mutual funds that offer built-in diversification.

C. Rebalance Regularly: Periodically rebalance your portfolio to maintain your desired asset allocation and manage risk.

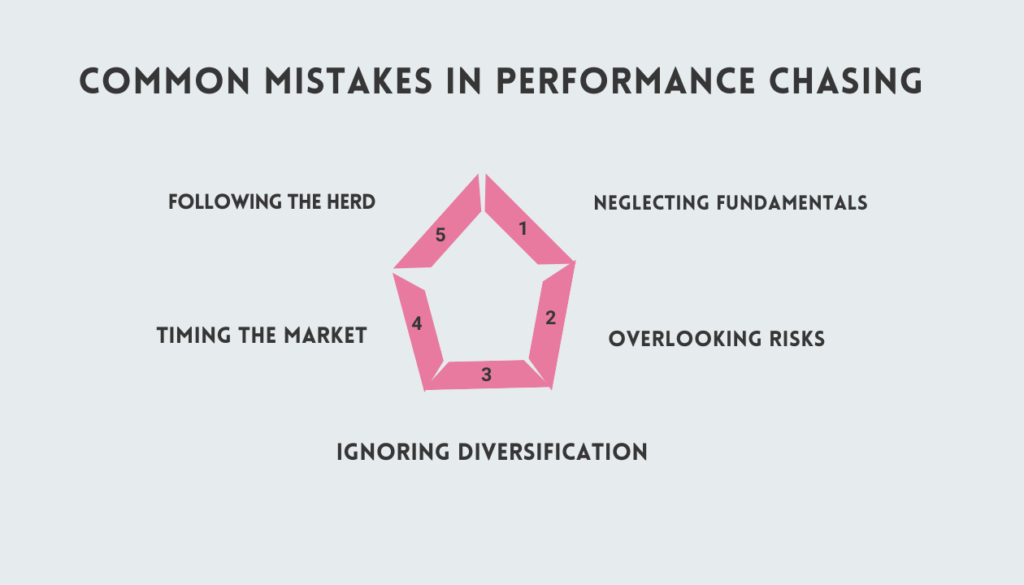

5. Chasing Past Performance

Investors often make the mistake of chasing stocks that have performed well in the past, assuming they will continue to do so. However, past performance is not always indicative of future results.

How to Avoid:

A. Focus on Fundamentals: Base your investment decisions on a company’s fundamentals, such as earnings growth, valuation, and competitive position.

B. Avoid Herd Mentality: Don’t follow the crowd or invest in stocks simply because they are popular or have recently gained attention.

C. Conduct Independent Analysis: Perform your own analysis and avoid being swayed by short-term market trends.

6. Neglecting Risk Management

Failing to manage risk can lead to significant losses, especially during market downturns. Risk management is essential for preserving capital and achieving long-term investment success.

How to Avoid:

A. Set Stop-Loss Orders: Use stop-loss orders to limit potential losses and protect your investments.

B. Understand Your Risk Tolerance: Assess your risk tolerance and invest accordingly, avoiding overly aggressive or conservative strategies.

C. Maintain Adequate Liquidity: Keep a portion of your portfolio in cash or liquid assets to manage unexpected expenses and market volatility.

7. Not Having a Clear Exit Strategy

Many investors fail to establish clear exit strategies, leading to missed opportunities or holding onto losing positions for too long.

How to Avoid:

A. Define Exit Criteria: Determine in advance the conditions under which you will sell a stock, such as reaching a target price or a change in fundamentals.

B. Avoid Emotional Attachment: Don’t become emotionally attached to your investments; be willing to sell when it aligns with your strategy.

C. Regularly Review Your Portfolio: Regularly review your portfolio to ensure it aligns with your investment goals and make adjustments as needed.

Conclusion

Avoiding common stock market mistakes is essential for achieving long-term investment success. By conducting thorough research, managing emotions, diversifying your portfolio, and adopting a disciplined approach, you can make informed investment decisions and improve your trading performance. Remember to stay patient, focus on your long-term goals, and continually educate yourself about the ever-evolving stock market landscape.

Frequently Asked Questions

1. What are some common mistakes new investors make in the stock market?

Ans. New investors often make mistakes such as lack of research, emotional trading, overtrading, ignoring diversification, chasing past performance, neglecting risk management, and not having clear exit strategies.

2. How can emotional trading affect my stock market performance?

Ans. Emotional trading can lead to impulsive decisions, buying high and selling low, and significant losses. It is important to stay disciplined and stick to a well-thought-out investment plan.

3. What strategies can help me avoid common stock market mistakes?

Ans. Strategies to avoid common mistakes include conducting thorough research, developing a clear investment strategy, diversifying your portfolio, focusing on long-term investments, and managing risk effectively.

4. Why is diversification important in stock market investing?

Ans. Diversification reduces risk by spreading investments across different sectors, industries, and asset classes. It helps protect your portfolio from significant losses if one investment underperforms.

5. How can I improve my stock market investment decisions?

Ans. To improve investment decisions, focus on fundamental analysis, avoid following the crowd, set clear exit strategies, manage risk, and stay informed about market trends and economic indicators.