Right from the very premise of investing in the stock market, the security of your hard-earned money should be one of your utmost priorities. Generally, risk management is performed with stop-loss orders, which are some of the most effective ways of performing investment safety. Such a tool may help you minimize losses and maximize gains so that you can trade with more confidence and at peace with yourself. Let’s dive in and see how you can use a stop-loss order effectively.

Table of Contents

1. What is Stop-Loss in Trading?

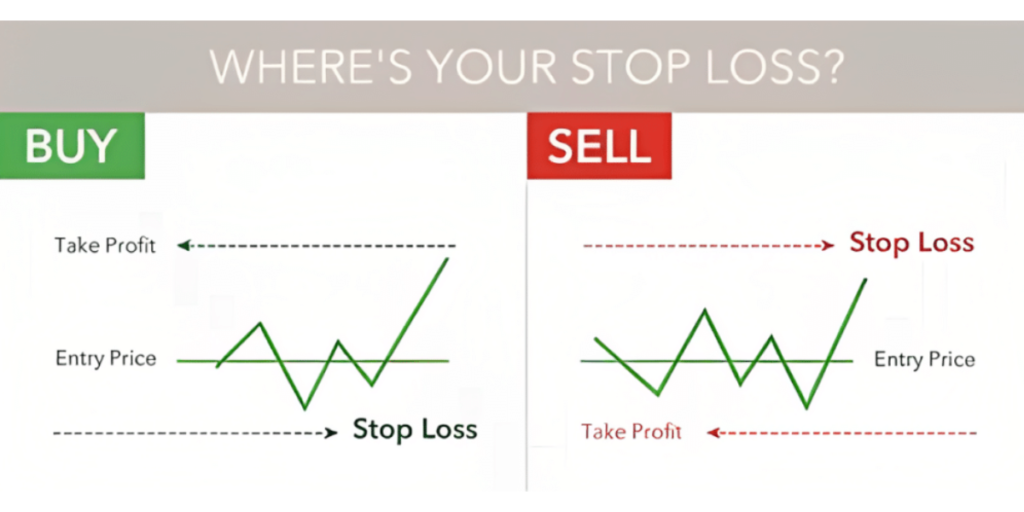

A stop-loss order is an order placed with your broker to sell a stock once the stock has declined to a certain price. This is the sort of order that will enable you to automatically limit the loss on a position through the selling of this stock before a further decline takes place. Think of it as insurance or a safety net that would catch you if the market turned against you.

For example, you purchase a stock at ₹100. You wish to avoid a big loss; hence, you place a stop-loss order at ₹90. In case the price of that particular stock falls to ₹90, your stop-loss will be triggered, and your broker will immediately sell that stock. You thus limit your loss to ₹10 per share instead of probably much more if the price keeps on falling.

2. Best Stop-Loss Strategy

The correct stop-loss strategy that will work depends upon one’s trading style, risk tolerance, and type of stock the investor is dealing with. The most popular stop-loss strategies include:

A. PERCENTAGE STOP-LOSS: This is the simplest approach, wherein one simply places the stop-loss a fixed percentage below one’s purchase price. For example, if one purchases a stock at ₹ 100 and accordingly places a 10% stop-loss, then the moment the stock falls to ₹ 90, the order will be triggered. This is the most simple and uncomplicated way of doing it; however, this may not exactly consider the volatility in the stock.

B. Resistance and Support Levels: So many stocks have certain key prices that they do not easily move through, whether to the upside or downside. A stop-loss placed just beneath these support levels may protect an investment without being stopped out by normal market noise.

C. Moving Averages: This involves setting stop-loss orders based on the moving average of a stock-a 50-day or 200-day moving average. When the stock falls below its moving average, that could mean the trend of that stock has reversed and it is time to sell.

D. ATR stop-loss: This is a method of determining the level of stop-loss based on the volatility of the stock. If a stock is highly volatile, then one needs to set wider stops to avoid being stopped out by a random swing in price. ATR gives more dynamism in the setting of the stop-loss since it automatically adjusts to the behavior of the stock.

3. What is a Trailing Stop Loss?

A trailing stop-loss is an adaptive kind of stop-loss order. It automatically changes with the movement of the stock price in order to lock a profit in while preventing your loss at the same time.

4. How does a Trailing Stop-Loss work?

Suppose you bought some stock at ₹100 and put a trailing stop-loss at 10%. The moment the stock price moves up to ₹120, your trailing stop-loss will automatically increase upwards to ₹108, 10% lower than ₹120. If the stock then falls to ₹108, the trailing stop-loss order is activated and the stock gets sold, thereby booking a gain of ₹8 per share. If the stock keeps making newer and newer highs, the stop-loss, in turn, goes up by moving higher and higher, thereby locking in more and more of your gains without your even adjusting it.

Stop-Loss Limit Order

The stop-loss limit order combines some features of a stop-loss and a limit order. Both a stop price and a limit price are set. When the stop is triggered, a limit order is placed to sell the stock at or above the limit price.

5. Example of a Stop-Loss Limit Order

Suppose you own the stock trading at ₹ 100 presently and put a stop-loss limit order with a stop price of ₹ 90 and a limit price of ₹ 88. The stock declines to ₹ 90, the order is triggered but it would sell the stock only if it can be sold at ₹ 88 or better. In case there is a steep plunge if the stock moves down too rapidly and does not reach your limit price, you might not get your order executed, thereby incurring more significant losses.

Read More:- The Role of ETFs in Stock Trading: Diversification Made Easy

6. How to Set a Stop-Loss in Zerodha Kite Mobile App

If you are using the most emerging online trading terminal in India, called Zerodha Kite, then here is how to set up a stop-loss:

A. Login to the Kite App: Enter your credential and login to the mobile app of Kite by Zerodha.

B. Select the Stock: Come to the stock on which you want to place a stop-loss.

C. Select the ‘Sell’ Option: After coming to the desired stock, click on the ‘Sell’ button to start the order placement process.

D. Select Order Type: Once you click on the ‘Sell’ button, the order form will open. Herein, you need to select ‘SL’ as the order type, which stands for Stop-Loss.

E. Trigger Price: This is the price at which your stop-loss would get activated.

F. Enter Price: The price at which you want to sell the stock when the trigger price is reached.

G. Place the Order: Verify all details and click ‘Place’ to place your stop-loss order.

7. Stop Loss vs. Stop Limit: What’s the Difference?

Understanding how a stop-loss differs from a stop-limit order is critical to successful trading:

A. Stop-Loss Order: This becomes a market sell order in case the stock reaches the stop price. It guarantees the selling of your stock but doesn’t guarantee the price at which the stock would be sold. It prevents you from further losses when the market is rapidly falling.

B. Stop Limit Order: Similar to a stop order, this order is also triggered when the stop price is reached but will only sell at a pre-set limit price or better. While this guarantees a minimum selling price, there’s a risk the order won’t get executed if the stock price falls too fast. This may leave you with an even bigger loss.

Read More :- Margin Trading: What It Is and How It Can Impact Your Portfolio

8. Which to Use?

If you’re more concerned with not having your stock sold to avoid greater losses, perhaps a stop-loss order is more fitting. If the primary goal is to sell at a certain price, and you are in a position to accept the risk that your order may not be executed, you may want to consider a stop-limit order.

Conclusion

Stop-loss orders work effectively to protect your investments and allow you to be responsible in this aspect of the business due to the fact that it governs risk and forces self-discipline upon you. Besides, knowledge of various stop-loss order types and strategies will enable you to mold any particular concept into a method which best suits your needs and tolerance for risk. Either through a basic stop-loss, a trailing stop, or stop-limit orders, the tools discussed here can become a critical safety net to give you the confidence and space to trade with less worry. No strategy is ever fail-safe; hence, what’s important is to choose one that will best fit your trading objectives and risk appetite.