As a beginner, the thought of investing in the stock market can be on the verge of anxiety. Ups and downs, tagged with jargons, when put against an assortment of options, may make one feel like they need a degree in finance to really succeed. You don’t have to be an expert, though Long-Term Investing is the key to growing your wealth. Building a portfolio for growth takes time, some discipline, and the most rudimentary understanding of the basics of the market.

This article serves to run you through the basics of long-term investing in trading stocks and help you put this knowledge into practice with wise decisions made on purpose. We will try to demystify important ideas, explain why long-term investment is so powerful, and tell you how to get started.

Table of Contents

What is Long-Term Investing?

Long-term investment is the way to buy and hold on to stocks for an extended period of time—five years or longer. Unlike trading in the short term, which targets quick profits by frequently buying and selling stocks, long-term investing seeks to increase one’s investment over time.

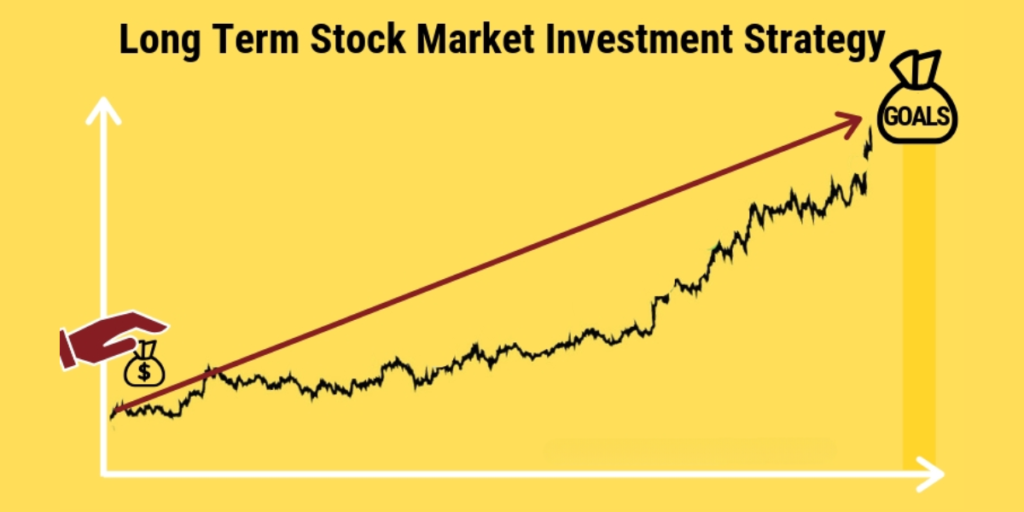

This strategy is based on the very principle that, despite the short-term volatility of the markets, the trend of the stock market has traditionally been upward. By continuing to hold your investments, you enable them to ride on this long-term growth.

Why Choose Long-Term Investing?

A. Compounding Returns: Probably one of the greatest benefits of investing for the long term is the power of compounding. It means that your investment earnings start working for you—generating earnings of their own. For instance, say you have invested in a stock that pays dividends. Well, those dividends could be reinvested to buy more shares. After some time, this cycle can actually pack a wallop on your returns.

B. Lower Risk: While no investment comes without some risk, long-term investing does reduce the risks of market fluctuations. In the short term, the price behavior of equities is marked by sharp swings because prices are determined by news, data, and investor sentiment. Over a longer period, most of these fluctuations get evened out by the market, promising more stable growth.

C. It Helps in Reducing Costs: The frequent buying and selling of stocks increase transaction fees and taxes that lower profit gain. Long-term investing reduces these costs, as you are trading less often. Holding the investments for over a year may also mean you will be required to pay a lower tax rate on those gains, known as the long-term capital gains tax.

D. Peace of Mind: Timing the market involves continuous monitoring, which may prove to be quite stressful. In investing for the long run, you can adopt a relaxed approach where you need not really bother about anything except the big picture, and once you have formulated your strategy, you are free from anxiety caused by short-term fluctuations in the market.

How to Start Long-Term Investing

Now that you understand the benefits, let’s look at how you can start building up your long-term investment portfolio.

A. Set Clear Goals: Before you get into investing, it will be important to define what your financial goals are. Are you saving for retirement, a child’s education, or buying a big-ticket item? Your goals will tell you your investment horizon—how long you have to invest—and your risk tolerance—how much risk you can take.

B. Educate Yourself: While you need not be a financial whiz, having a basic understanding of the very fundamentals of the stock market and the various investment options is of essence. Read books and journals on financial issues and follow-up financial news while considering online courses.

C. Start with a Plan. A good investment plan is the root of any long-term success. Your plan should include how much you are going to invest, how often you are going to invest, and the kind of investments you are going to focus on. For example, you may want to invest a certain percentage of your income each month in a diversified portfolio of stocks and bonds.

D. Diversify Your Portfolio: The very elementary basics in the case of investing for a long period of time is diversification. This means investing in a pool of diverse asset classes, such as equities, bonds, and real estate, and sectors like technology, healthcare, or consumer goods. This reduces your risk because it makes sure that your portfolio is not drastically affected by the downturn in one area.

E. Invest in Quality Stocks: While picking individual stocks, look for business enterprises that exude strong fundamentals. They are the companies that boast an earning record, a competitive advantage in the industry, and good management. These companies are more likely to grow over time and provide steady returns.

Read More:- Master Swing Trading: Essential Strategies and Stocks, Intraday Trading: Effective Techniques for Success

F. Consider Index Funds: If you don’t feel comfortable picking individual stocks, take a look at investing in index funds. These funds are linked to some particular index, such as the S&P 500, and automatically diversify your investment in all companies listed in that index. Index funds are one of the cheapest, least time-intensive methods for tapping into the long-term growth of equity markets.

G. Steer the Course: Most of the challenges in investing for a long time span are maintaining discipline, more so during the bad times in the markets. It is quite natural to get worried if your investments devalue, but panicked selling can end up crystallizing losses. Be reminded that the market generally bounces back from downturns and that selling during a dip may keep you from participating in a recovery.

H. Review and Then Adjust: While long-term investing is about patience, it’s equally about periodically reviewing your portfolio. Check in once or twice a year to make sure that you are still investing towards the goals-targets set for retirement. In case you reach closer to retirement, or any other such milestone change occurs, you may need to change your strategy.

Long-Term Investing Strategies

Long-term investing means buying quality investments, such as stocks or bonds and holding them for a period of years to let them grow in value. If you regularly invest a set amount of money, this lowers the chances of market fluctuation. Further down the line, reinvesting dividends and diversifying across different assets will further your money’s growth. One can try to maximize returns through tax-advantaged accounts—like 401(k)s—by delaying or avoiding taxes on one’s gains. The key is patience: it means staying invested during the bad times to assure a strong financial future.

Common Mistakes to Avoid

Even with the best of intentions, it is easy to commit a few common mistakes when investing. Here are a number of common pitfalls to watch out for:

A. Chasing Hot Stocks: The very thought of riding the coattails of some hot stock making headlines is rather tantalizing. However, taking a position in a stock solely because it is popular is very risky. More often than not, by the time a stock becomes the talk of the town, its price has already been inflated quite a lot. Stick to your plan and invest in quality.

B. Timing the Market: Timing the market—buying low and selling high—is very difficult even for the professional investor. The equity market is simply too unpredictable, and any effort at timing may result in serious errors. Instead, focus on staying invested for the long haul.

C. Ignore the Fees: Although investment fees may seem minor, over time, they do add up and can take a big slice of your returns. Be aware of the fees associated with your investments, such as mutual fund management fees or trading fees for the purchase and sale of stocks. Then, find low-cost options like index and exchange-traded funds.

D. Overreacting to market news: The financial press adores sensationalizing changes in the markets. Hence, emotions can lead to wrong decisions. It is important to turn off the noise and maintain a long-term strategy. Remember, short-term volatility is normal and the market has always trended upward over the long term.

E. Not Reinvesting Dividends: Invest in dividend-paying stocks, but try reinvesting those dividends instead of taking the cash. You are using the dividends to buy more shares and increase returns by compounding.

The Rewards of Patience

Long-term investing isn’t about getting rich quickly. It is about slowly but surely climbing up the ladder in wealth creation over an enormous period of time. This very clearly requires vast time, patience, discipline, and readiness to rise in the face of market fluctuations. But for those who have been in it long enough, the rewards can be substantial.

More importantly, design an investment of high quality, diversify your portfolio, and keep it up, so the best path for financial growth can be respired that will patronize your goals and secure your future: Whether it’s saving for retirement, funding your children’s education, or just building a nest egg, investing for the long term in the stock market has proven to be the best approach to realize your financial dream.

Conclusion

Long-term investing in the stock market is not an endeavor reserved for the wealthy or for experts in finance; rather, it is a certain method of growing money available to anyone. Having clear goals, being educated, and disciplined will help you sail through the stock market with confidence. Remember: All it needs is thinking long term, patience, and just letting your investment take its due course through time. With this kind of approach, you are already on your way to building a firm financial superstructure for the future.