Investment in the stock market is a journey of opportunities, risks, and decisions. Among the different tools available to traders and investors, margin trading occupies a prominent position for its great potential to amplify gains and losses. Such a powerful tool does require some solid understanding and careful management. In this article, we are going to dive into what margin trading is, how it works, its benefits, risks, and how it can affect your portfolio.

Table of Contents

1. What is Margin Trading?

It means, in simple language, margin trading-taking an actual loan from a brokerage firm to buy securities. In other words, it is using a loan to extend one’s buying power to buy more than one could with just one’s own money. The money that you borrow, or margin, is a line of credit that your brokerage firm extends to you, and you will be required to pay back this amount along with interest.

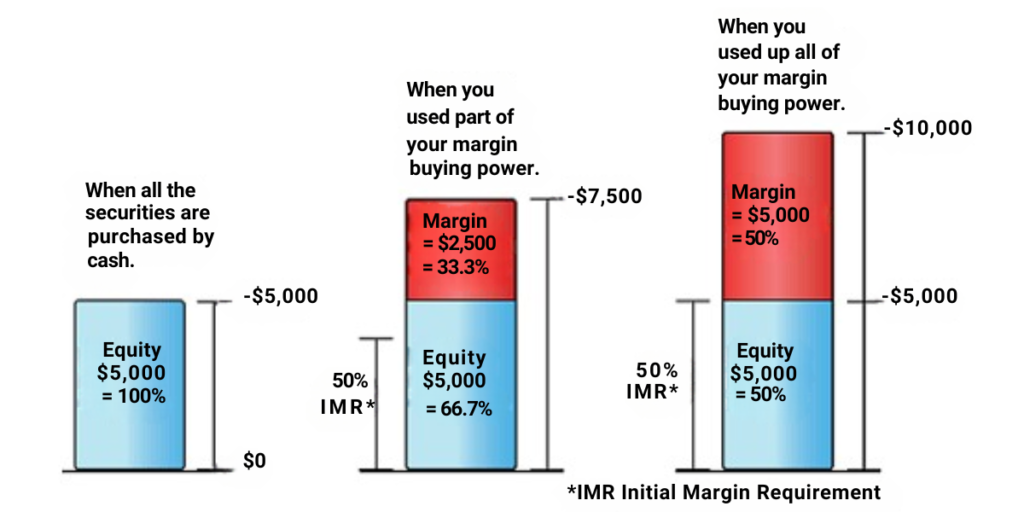

A simple analogy is as follows: Suppose you have $5,000 and wish to purchase some stock in a company. In regular trading, you will only be able to buy $5,000 worth of shares. If your broker is offering a 50% margin with margin trading, then that means you can borrow an additional $5,000 from your broker to purchase $10,000 in shares.

While this may sound like an excellent way of maximizing profits, it should be kept in mind that margin trading involves considerable risks also.

2. How Does Margin Trading Work?

First things first, to margin trade, you must have a margin account with your broker, something quite different from a regular cash account. Here’s how this often works:

A. Initial Margin Requirement: The client has to deposit a certain percentage of the total purchase price, called the initial margin, on the first purchase of securities on margin. For example, with an initial margin requirement of 50%, you would be able to pay half of the purchasing price immediately while the rest is borrowed from your brokerage firm.

B. Maintenance Margin: If one purchases securities on margin, then he has to maintain at least a fixed level of equity in the margin account. This fixed level of equity in a margin account is called maintenance margin. If one’s equity subsequently falls below this level due to market losses, your broker may issue a margin call where you may be required to deposit more funds or sell off some securities to bring your account back to the specified level.

C. Interest and Fees: It is not free to borrow on margin. The brokers charge interest on the amount of borrowed funds, which actually piles up over the period. Furthermore, if you hold the securities for a fairly long period, such costs will be eroding your profits.

3. Risks Involved in Margin Trading

As good as the benefits of margin trading sound, there is a need to take notice of the attendant risks. Margin trading isn’t for everyone, and one must tread with utmost care:

A. Increased Losses: Margin trading has the capability to leverage your profits, but at the same time, it can magnify your losses. What this means is that the market can go against you and make you lose more money than your initial investment. In some instances, one might end up owing more than his initial investment, which is intolerable financially.

B. Margin Calls: Your broker may make a margin call where the value of the securities you have purchased with credit from him drops and your equity decreases beneath the maintenance margin requirement. This affords you the opportunity to deposit more funds or to sell assets to meet the margin requirement. Failing which your broker can check the positions and probably liquidate them, which will mean selling them at a loss.

C. Interest Costs: The interest charged on the amount of money that you have borrowed stands a good chance of adding up relatively quickly, especially if you hold your positions over a long period. These costs will eat into your profits or add to your losses.

D. Market volatility: It is not possible to predict the stock market’s behavior, and changes in prices may occur, making a difference in your margin account. As a matter of fact, even a small drop in the value of your investments can result in the margin call that requires urgent action on your part.

E. Psychological pressure: Margin trading may add an extra layer of stress and pressure on your decisions concerning investment. That a trader is capable of suffering a loss higher than the money invested and requires very close monitoring of the position makes the possibility of emotional decision-making quite likely-which is rarely in your best interest.

Read More :- The Role of ETFs in Stock Trading: Diversification Made Easy

4. How Margin Trading Can Affect Your Portfolio

Margin trading can have a dramatic, sometimes extremely positive, and at other times very negative, effect on your portfolio. Understanding this effect is vital in making a decision as to whether margin trading is for you or not.

A. Higher Returns: Margin trading offers the possibility of much greater returns than standard investing in a market moving in your favor. For example, if you purchase any stock on margin and then its price goes up, the percentage of your gain will be higher compared to if you bought that stock with just your money. This can speed up the growth of your portfolio and help you achieve your goals more quickly.

B. Increased Risk and Volatility: Margin trading does increase the volatility and risk of your portfolio, though. These greater losses will further increase the speed of decline of your portfolio during market downturns. This higher risk could make it very volatile and hard to manage.

C. Impact on Investment Strategy: It might affect the investment strategy. For example, if your aim is to realize long-term growth, margin trading would not fit into your criteria because of the risks and added costs associated with margin trading. If you are a sophisticated trader who enjoys taking risks, margin trading can be a means to give a boost to your returns.

D. Long-term Effects: Margin trading, if not dealt with cautiously, may have long-run effects on your financial health. A huge loss in margin trading will obviously push back your goal of achieving financial success and will take more than a few years to rebuild. One must think over the probable long-run effect of margin trading before venturing into the same.

Conclusion: Is Margin Trading for You?

Margin trading is both a sword and a shield. Inasmuch as it promises possibly higher returns with greater flexibility, the risks that come along are just as enormous. Margin trading entails an assessment of your risk tolerance, present financial condition, and investment objectives in advance. In the case of most investors, the risks thus associated may as well be heavier than the possible benefits, and conventional ways of investing could prove far safer.

So, if you do take the plunge and dabble a little in margin trading, go small, learn as much as you can about it, and always be ready to jump out quickly when the market turns against you. Yes, margin trading could become a useful tool in your investment toolbox after all, with due care and attention to all the risks involved. It’s just not something for all audiences. Be sure that you keep one tenet of truth in your mind: capital protection is paramount and should stand above all other investment rules.