For most people, investing is something of a mystery because it is either time-consuming or requires a lot of expertise one may not have to actively manage investments. This is where mutual funds come in: allowing you to grow your money conveniently through professional management. This article will break down what a mutual fund is, how it works, and why it is an investment avenue that might be right for you.

Table of Contents

1. What Are Mutual Funds?

A mutual fund is an investment vehicle that pools money from many different investors to invest in a diversified portfolio of various stocks, bonds, or other securities. Then it is managed by professional fund managers who decide upon the buying, holding, and selling of securities based on the investment objectives.

2. How Do Mutual Funds Work?

When you invest in a mutual fund, your money, in combination with money from all other investors, gets put into a big pool of money. Thereafter, such a big pool of funds is invested in a diversified portfolio of securities, which helps in spreading the risk across different investments. The mutual fund’s performance links to the collective performance of the securities purchased.

The shares are representations of the holdings of a fund, and the value of such shares an investor has in a fund is called the Net Asset Value, which changes daily according to the market value of the securities held.

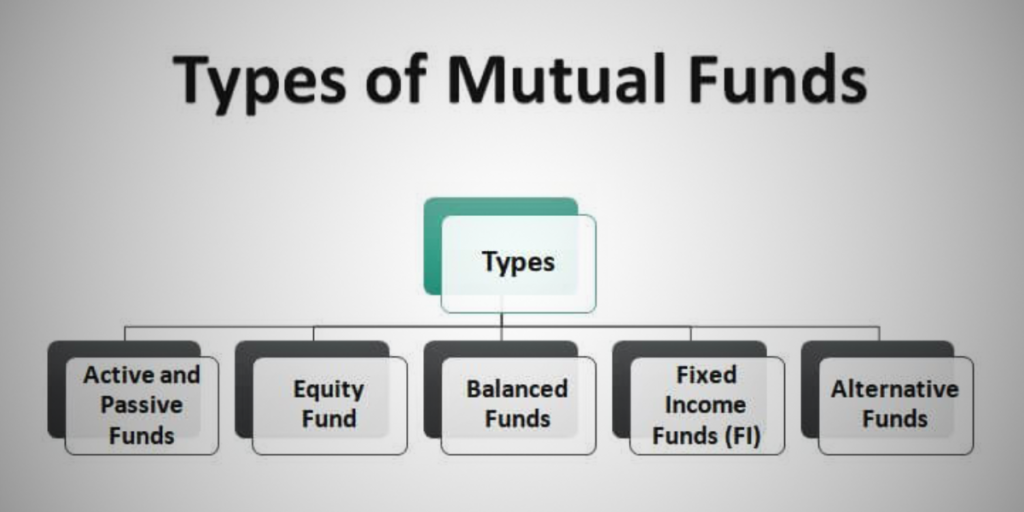

3. Types of Mutual Funds

There are innumerable types of mutual funds that have diversified investment objectives and strategies. The knowledge of the types can help you in picking up the right fund for your financial goals.

A. Equity Funds: They mainly invest in stocks and have the objective of capital growth. They can further be divided into large-cap, mid-cap, and small-cap funds, wherein the latter refers to the size of the companies they invest in.

B. Bond Funds: These are also called fixed-income funds. They primarily invest in bonds and other debt instruments. Compared to equity funds, they are considerably risk-free, but the returns are also comparatively lower.

C. Balanced Funds: It is a fund that combines the investment of stocks and bonds to balance the risk with returns. It seeks to provide growth with income.

D. Index Funds: These funds invest in a wide diversification of securities to provide investors with returns similar to that of a particular market index, like the S&P 500. This provides broad market exposure at a lesser cost in terms of management fees.

E. Money Market Funds: They basically invest in short-term, low-risk securities, including Treasury bills. They are pretty risk-free; the returns on their part are minimal.

F. Sector Funds: These invest in the different sectors of the economy, like technology or health. They hold the promise of higher returns with higher risks.

G. International Funds: These funds are invested in companies outside one’s home country and provide exposure to international markets.

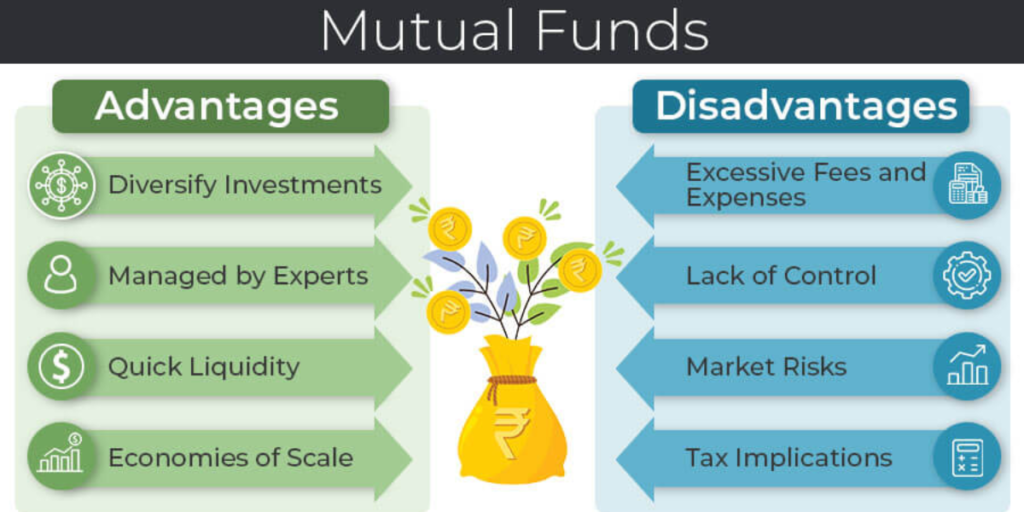

4. Advantages of Mutual Funds

There are several advantages mutual funds have, making them very attractive to many investors, more so the beginners.

A. Diversification: Because mutual funds pool money from a lot of different investors, they can invest in an array of securities. The diversification will then qualify for a risk reduction in relation to an individual investment.

B. Professional Management: Mutual funds are managed by professionals who make investment decisions based on research and analysis. This takes the burden of managing the investments off your shoulders.

C. Liquidity: You can easily buy and sell mutual funds, providing liquidity to investors. You are always free to sell your shares anytime; hence, this is a flexible investment option.

D. Affordability: With a relatively small amount of money, you can invest in a diversified portfolio. This brings mutual funds within the reach of the common investor.

E. Convenience: Purchasing mutual funds is not a tedious task. It is fairly easy to buy them through brokers, financial advisers, or directly from the mutual fund companies themselves.

5. Disadvantages of Mutual Funds

Though mutual funds have many advantages, they also have their drawbacks.

A. Fees and Expenses: A mutual fund comes with all types of fees and other expenses, which eat into your returns. You should be aware of what you will be charged prior to investing in such funds.

B. No Control Over Holdings: You have no direct control over which securities the fund invests in. All decisions are made by the fund manager.

C. Lower returns: Since mutual funds are diversified, they may not attain the really high returns which a concentrated investment might. This, again, is a price you pay for reduced risk.

D. Capital Gains Taxes: When a mutual fund sells securities at a profit, it passes the gains to the investors in terms of taxable income. So, even if you had not sold any of your shares, there can be a tax incidence on your ownership.

Read More:- Algo Trading: A Simple Guide for Beginners in 2024, Long-Term Investing: A Strategic Path to Financial Growth

6. How to Choose the Right Mutual Fund

To find the right mutual fund, you should first consider your financial goals, risk-appetite, and investment horizon. Some suggested steps follow:

A. Define your objectives: this determines what you aim at achieving at the end of your investment. Are you saving for retirement, buying a car, or for general wealth maximization purposes? These goals will drive your fund choice.

B. Measure your risk tolerance: Consider how much of a gambler you are. If you really are very averse to risk, then you may want to invest in a bond or money market fund. But if you’d like a little more risk, you can go ahead with an equity or sector fund.

C. Consider the Time Horizon: The length of time you have to invest also impacts your fund selection. Long-term investments may allow aggressive stance, while short-term ones need more conservative attitudes.

D. Check Research Funds Performance: Look out at the past fund performance, keeping in mind that this is not indicative of future results. Note how the fund did against peers and benchmark indices.

E. Check Fees and Expenses: Compare fees and expenses from one fund to another fund. Lower fees mean more of your money will be invested and will have the potential to grow.

F. Examine the Track Record of the Fund Manager: The experience and expertise of the manager are very important for running the fund. One needs to look for a manager who can show a proven track record.

G. Read the Fund’s Prospectus: The prospectus normally contains detailed information about the objectives of the fund, strategies to obtain those objectives, risks involved, and fees. It is essential reading for any prospective investor.

7. How to Invest in Mutual Funds

Once you’ve picked a mutual fund, the actual process of investing is fairly straightforward.

A. Open an Account: You can open a mutual fund account directly with the fund company, through a brokerage firm, or via a financial advisor. Some online platforms also offer easy access to mutual funds.

B. Make an Initial Investment: Most mutual funds have an initial minimum investment requirement, which usually varies from some hundred to some thousands of dollars.

C. Automatic Investments: In many funds, it is possible to set up automatic investments from your bank account; this makes it very easy to contribute on a regular basis and take full advantage of dollar-cost averaging.

D. Keep Tabs on Your Investment: Continually be aware of your investment and occasionally assess its performance. While mutual funds are meant for long-term investment, you have to ensure they remain committed to your goals.

E. Sell Your Shares: In case you require your money, your mutual fund shares can be sold in the prevailing NAV. The money is, usually, made available within a few business days.

Conclusion

Mutual funds offer a painless and efficient way to invest in a diversified portfolio without requiring undue knowledge or time on your part. Pooling your resources with those of other investors, you can have professional management, reduce risk, and accomplish financial goals, at least in theory. Nevertheless, do remember that homework is an integral part of things. Understand the fees involved and risks, and select a fund that dovetails with your unique needs. With some careful planning and due consideration, mutual funds can form a very useful part of your investment strategy.

Frequently Asked Questions

Q. How can I make money from a mutual fund scheme?

A. When it comes to mutual funds, an investor can make money in two possible ways: income earned from dividends on stocks and price increase of the stock.

Q. Can I lose my money in a mutual fund?

A. Theoretically, yes. But if you stay invested long enough, that possibility goes down to almost zero.

Q. Is investing in mutual funds a good idea?

A. The purpose of investing in mutual funds is to earn higher returns than what traditional investments offer. These higher returns are mainly because of more extensive market exposure and professional fund management. This is available at a nominal initial capital via the Systematic Investment Plan (SIP) route. So, it is a good idea.

Q. How do I invest in mutual funds?

A. First of all, an investor must understand his risk capacity and assess financial goals. This process of identifying the amount of risk one is capable of taking is referred to as risk profiling. The next step is asset allocation – once the risk profile is identified, the money must be divided between various asset classes. Next, the funds to be invested in each asset class must be identified. One can compare mutual funds based on the investment objective and past performance.

Q. Are mutual funds better than stocks?

A. Stocks are generally riskier than mutual funds. When an investor pools in a lot of stocks in a stock fund or bonds in a bond fund, mutual funds reduce the risk of investing. This lowers the risk, thanks to diversification. For that reason, many investors feel that mutual funds provide the benefits of stock investing without the risks.