Many people think of investing in the stock market, whereby one buys shares in the hope that the value rises over time. However, there is another strategy which flips this convention on its head: short selling. It’s an investment technique that allows the investor to make gains from a falling market; it comes with several risks and rewards. In this blog, we delve into the world of short selling: what it is, how it works, what it means within the stock market, its advantages, and a basic example.

Table of Contents

1. What is Short Selling?

Short selling is an investment technique through which an investor bets on the decline in the price of any particular stock. While in traditional investing, one buys a stock, hoping its price goes up, in short selling, one borrows shares from someone else, sells them at current market prices, and then buys them later at a lower price to return to the lender. The difference between the selling and buying price is his profit.

2. How Short Selling Works

A. Borrow the Shares: First, you have to borrow the shares from the broker. The shares belong to another investor who has them in his account; he is temporarily lending them to you.

B. Sell the Shares: Having borrowed the shares, you sell them immediately at the current market price. You are now hoping that in the future, the price will go down.

C. Buy Back (Cover the Short): After some period of time, if the price has indeed fallen, you cover the short by buying back that number and amount of shares at the lower price. That is now called “covering” the short position.

D. Return Shares: You give back the shares you borrowed from the broker and take the profit that results from the difference between the price you sold the shares at, and the price you bought them back at.

E. Returning Shares: You return the broker the loaned shares and take the difference between the price you sold the shares at and the price you bought the shares back at.

3. What does it mean to you in the stock market?

Short selling in the stock market is the method that investors use to make returns if they feel a particular stock is overpriced, or if a company’s prospects look dim. Instead of just avoiding the stock, they actively bet against it. Short selling can be one method for profiting from the decline of a market or particular companies that are expected to fare badly.

While it is primarily provided for professional traders and institutional investors, even a small investor can short sell as long as one has a margin account with their brokerage. It is an activity that has risks associated with it.

Read More :- The Fundamentals of Growth Investing in the Stock Market

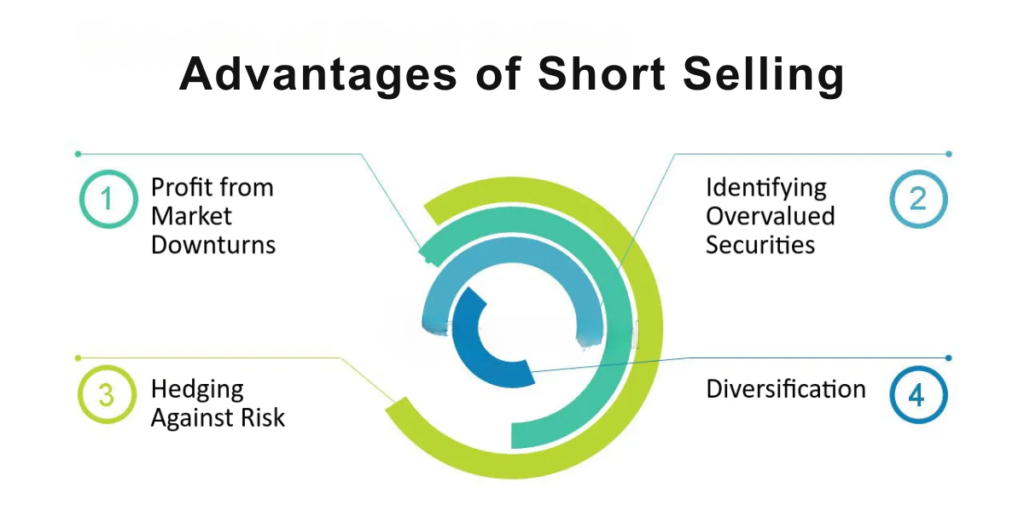

4. Advantages of Short Selling

Short selling has a host of advantages in a market environment where stock prices are falling or perceived to fall. Let’s look at some of the advantages.

A. Potential for Profit in a Declining Market

Perhaps the most obvious benefit that comes with short selling is to an investor who has the potential to make a profit on falling stock prices. In those periods of time when a bearish market predominates and most stocks are falling in value, the traditional long-only investor would find their opportunities greatly diminished. Short sellers, however, could exploit the bear market by simply betting against the stock prices they perceived as likely to fall.

B. Hedging Against Other Investments

It can also be used as a hedging tool. A good example could be that if an investor is holding a long position in a particular sector and is skeptical about the mere possibility of short-term volatility, he may short-sell stocks belonging to that sector with a view to protecting his portfolio. In this case, if the sector goes down, the losses on the long positions can be set off by gains from the short positions.

C. Unmasking Overvalued Stocks

Short selling can also serve as a means to bring forth overvalued equities or companies with poor fundamentals. When a large number of investors are short selling a particular stock, this is a signal to the market that the underlying revenues for the company might be at fault. This shall encourage further investigation by other market participants and may even compel the management of the company to course-correct.

D. Market Efficiency

This, in turn, improves market efficiency as the prices of stocks reflect the true value of a firm more accurately. In taking a negative view on an overpriced stock, short sellers serve to correct market overvaluations; hence, this keeps the market in balance and basically makes it fair.

5. Risks of Short Selling

While short selling offers potential benefits, it’s equally fraught with risks. Any person who is considering this strategy must understand these risks.

A. Unlimited Losses

Perhaps the biggest risk of short selling is the potential for unlimited losses. When you buy a stock, the most you can lose is whatever you put into it because the stock price can’t go below zero. However, if you short a stock, it theoretically could go to any height in terms of price, so your losses could also theoretically be unlimited. And if the price suddenly surges, you may be forced to repurchase the shares at a considerably higher price than you had sold them for, resulting in huge losses.

B. Margin Requirements

Because this involves a margin account-meaning that you are borrowing money from your broker to do the trade-brokers have minimum margin requirements you’ll have to keep. In such a case, if the stock price moves against your position, then you are risking getting a margin call. Talks for explanation would thereby be that you will need to deposit more money into your account to cover the potential losses, or your position would get liquidated at a loss.

C. Timing and Market Sentiment

With short selling, timing is everything because market sentiment can change in a very short while. You may end up incurring losses before the stock price begins to decline if you do short too quickly. Sometimes an announcement of unexpected good news for the sector or company can cause the share price to shoot up and catch the unsuspecting short sellers.

D. Short Squeeze

A short squeeze is a situation where a hugely shorted stock surges upward in price, with the result of forcing the short seller to buy back stocks in order to cover his or her position. This momentum from buying generally leads to further price increases of the stock-a self-serving cycle into more and more short sellers being squeezed out of their positions at heavy losses.

Read More :- Value Investing : A Simple Guide to Building Wealth

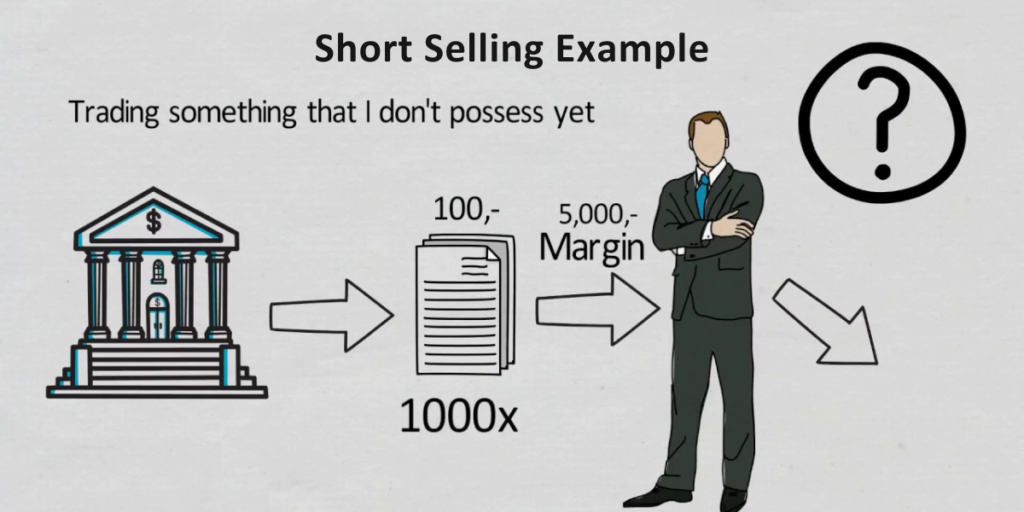

6. Short Selling Example

An example will be broken down in order to explain how a short sell works.

Example Scenario:

Suppose you are an investor who feels that Company XYZ’s stock, trading at $100 per share, is overpriced and bound for a price decrease in the near term. You want to short sell 100 shares of XYZ.

A. Sell and Lend: You borrow 100 shares of XYZ from your broker and immediately sell them in the market at the current market price of $100 per share. This gives you $10,000 in cash against your loan of 100 shares at $100 per share.

B. Stock Price Declines: In the weeks that follow, as anticipated, the stock price of XYZ collapses to $70 per share.

C. Buy Back Cover the Short: You decide it’s time to close your short position and buy back the 100 shares at the lower price of $70 a share. This will cost you $7,000 100 shares x $70 per share.

D. Gain: You purchased the shares back for $7,000 and return the 100 shares to your brokerage firm. Your gain from the short sale is the amount that you sold the shares for minus the amount you paid to purchase them: $10,000 – $7,000 = $3,000.

7. What If the Price Goes Up?

Now, let’s consider what would have happened had the stock price of XYZ gone up instead of down.

Had the stock price gone up to $130 per share, you would still have been required to close out your 100 shares in XYZ and replace them with your broker. But this would have now set you back $100 x $130 per share = $13,000.

Here, you will be at a loss of $3,000 ($10,000 – $13,000), which just shows the risk involved in short selling if the market does not move as you expect.

Conclusion

Short selling is an effective way of investing that may yield profit in a downward market but, like any other investment strategy, is not without most serious risks. Short selling demands a very good understanding of the market, perfect timing, and a case of steel-bladed nerves against probable losses. While the prospect of profit to be had from a bear market is tempting, a short seller always needs to be prepared for any particular short squeeze or other unexpected market movement causing considerable loss.

To those who understand the risks and are willing to take them, there can be little doubt that it will form a valuable part of their investment toolkit. Of course, it is a strategy to apply with care, and its use should be considered as part of a well-balanced investment strategy. Whether you have been trading these markets for many years or are brand new to stock trading, short selling is a technique to be applied with caution and at full knowledge of the dangers presented.