It might seem that investing is long-term, and an investment world full of terminology. Not all investments are necessarily for the long haul, though. If you’re looking for quicker returns or want your money accessible, then short-term investments are the way to go. We will discuss in detail what short-term investments are, how they work, and some of the available popular options.

Table of Contents

1. What Are Short-Term Investments?

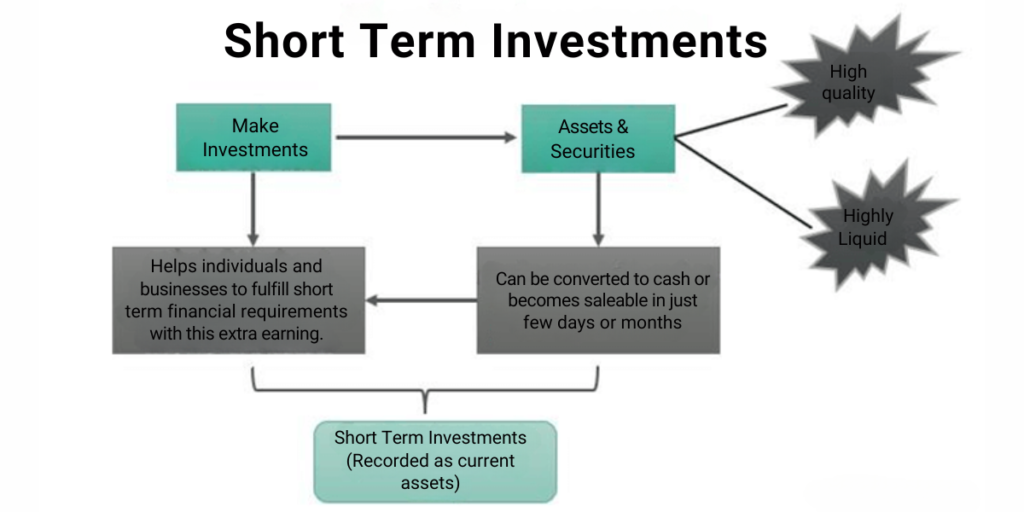

Short-term investments involve financial assets that can be easily converted into cash or fall due within a short period, usually less than three years. These investments are designed to be more liquid, meaning you’ll have ready access to your money relatively quickly without waiting for years.

Most of the short-term investments are in the business to give their money a chance to grow while keeping it relatively safe and accessible. Such types of investments will be suitable for people who may need their money in the near future, such as when one is about to go on a vacation, pay a down payment for a house, or for one to have an emergency fund.

2. How Do Short-Term Investments Work?

Most short-term investments focus on safety and liquidity as against high returns. These investments have a shorter duration; therefore, they are not exposed to the same kind of volatility as stocks or other long-term investments. However, this does mean that the returns may be lower.

This is how most short-term investments work:

A. Low Risk, Low Return: Most short-term investments have lower returns as they are supposed to be safe, in comparison to long-term investments. However, on the other side, there’s also a lower risk of losing your principal money in such an investment.

B. Easy Access: Probably the biggest advantage of such investments is that they are highly liquid. That is, short-term investments can easily be withdrawn whenever there is a need for cash within a short period of time.

C. Diverse Options: There are all kinds of STI options out there, designed to meet divergent needs and risk tolerance. Be it ultra-safe, looking to take on just a little more risk for slightly higher returns, chances are there’s an option to suit your needs.

Read More :- Groww vs Zerodha Broker Comparison | Which is Better

3. Examples of Short-Term Investments

Let’s look at some of the more popular short-term investment options you might want to consider:

A. Savings Accounts

Savings accounts are one of the most secure places to park your money. They are offered by banks and credit unions, whereby they allow you to earn interest on your deposits. The interest rates on savings accounts are pretty low compared to other investment options, but you do get easy access to your funds whenever you want.

B. Certificates of Deposit (CDs)

A Certificate of Deposit, or CD, is a type of time deposit offered by the bank. When you put money into a CD, you’re locking your money with the bank for a certain period, ranging from just a few months to a few years. In exchange, you get a fixed interest rate paid by the bank. The catch? You could face a penalty if you withdraw your money before the CD matures. However, if you do not need immediate liquidity, then it is a good way to get a slightly higher return than in a savings account.

C. Money Market Accounts

Money market accounts are similar to savings accounts, though they typically offer higher interest rates. They often have restrictions, such as requiring a higher minimum balance or limitations on the number of monthly transactions. The investments for these accounts involve low-risk securities, so they are far more secure, with a slight possibility of return, compared to a regular savings account.

D. Treasury Bills (T-Bills)

Treasury bills are short-term government securities that have maturities from some few days to a year. They are considered very safe because the government backs them. You buy them at a discount to their face value, and you receive the full face value when they mature. The difference between the purchase price and the face value is the interest you earn.

E. Short-Term Bond Funds

Funds of short-term bonds: Bond funds that mature in only a few years or less. Such funds can pay a bit more than a savings account or CD with only a bit more risk. The prices of bonds can move in the opposite direction of interest rates, so the value of your investment may fluctuate. However, short-term bond funds are usually much more stable than long-term bond funds, making them a good middle-ground choice.

F. Peer-to-Peer Lending

P2P lending platforms enable individual investors to lend money to people or small businesses in exchange for interest paid on their loans. This increases the potential rate of return compared to a conventional savings account or a CD but comes at higher risk since the borrower may default. Before investing in a platform, it’s very important to research and understand the platform and risks associated with it.

Read More:- What is Options Trading – Definition, Types and Strategies

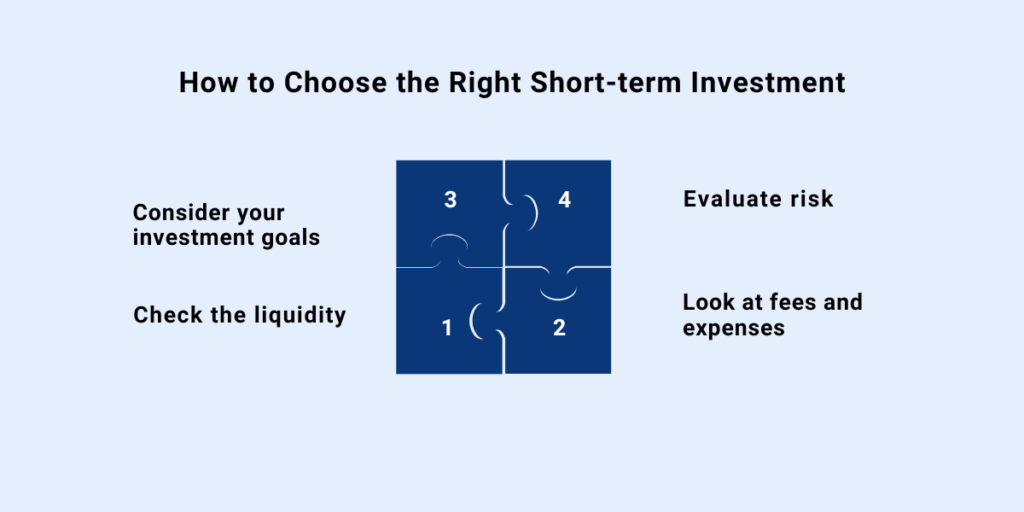

4. Picking the Right Short-Term Investment

When you’re looking to make a short-term investment, consider your risk tolerance, the money you have to invest, how quickly you might need to get access to your cash, and the possible returns.

A savings account or a money market account is all you might be looking for if you think safety and liquidity are your top priorities.

You might want to see if CDs or T-bills provide better returns if you can afford to lock your money away for a set period.

The following may be some options that you should consider if you are willing to bear a bit more risk for higher returns: short-term bond funds and peer-to-peer lending.

Conclusion

Short-term investments help you increase the amount you have invested while keeping the money liquid and safe. It does not really matter whether you are saving toward a short-term goal or simply looking to park your cash in a place where it can earn some interest—there are plenty of options. Understanding how these investments work and what each one offers will put you in a better position to make the right choices that will suit your financial goals. Remember, the returns will be not that good as for long-term investments, but the key advantage here is that you have your money for use when needed!