Picture yourself owning a small part of some of the world’s largest companies such as Apple, Amazon, or Coca-Cola. Sounds exciting, right? That’s what happens when you purchase stocks. Stock trading gives average people like you and me the chance to own a tiny slice of massive corporations and earn money from their achievements. But how does this process work? What motivates individuals to get involved in stock trading, and what should you understand before jumping in?

In this article, we’ll explain the fundamentals of stock trading in clear straightforward terms. This guide will help you catch up, whether you’re brand new to the stock market or just need a quick review.

Table of Contents

1. What Are Stocks?

Let’s kick things off with the basics before we dive into the nitty-gritty: What are stocks?

Stocks, which people also call shares or securities, show that you own part of a company. When a business needs cash to grow, it can sell shares to the public. If you buy a share, you become the owner of a tiny piece of that company.

When a company performs well and grows in value, its stock price might increase allowing you to sell your shares at a profit. But if the business faces challenges, the stock price can fall leading to financial losses. A company is like a large pie, and owning stock is similar to having a slice of that pie. Your ownership stake (or the number of shares you possess) shows how much of the company belongs to you.

2. Why Do Companies Issue Stocks?

Companies release stocks to get money—funds they can use to start new projects grow their business, or clear their debts. Rather than getting a loan from a bank and paying interest, a company can sell ownership parts to investors through the stock market. This helps them obtain the money they need without having to pay it back as they would with a loan.

3. How the Stock Market Works

We now grasp the concept of stocks and the reasons companies issue them. Let’s dive into the workings of the stock market.

The stock market resembles a massive auction house to buy and sell stocks. It serves as a place (or, to be exact, a network of places) for buyers and sellers to meet and trade shares. Share prices change based on supply and demand, similar to how goods’ prices shift at an auction.

A stock’s price goes up when more people want to buy it than sell it. On the flip side, if the number of sellers outweighs buyers, the price drops. This ongoing price movement creates chances for traders to earn money.

4. Stock Exchanges

Stocks are traded on stock exchanges, which are organized markets for the purchase and sale of stocks. The London Stock Exchange (LSE), the Nasdaq, and the New York Stock Exchange (NYSE) are the three best-known stock exchanges.

These exchanges provide a well-defined and controlled environment where buyers and sellers can trade shares. Companies list their stocks on exchanges to appeal to investors. For instance, Apple trades on the Nasdaq, and Coca-Cola trades on the NYSE.

5. Brokers: Your Gateway to the Stock Market

You will need a broker to trade in stocks. In general, a broker refers to a licensed professional, company, or entity who acts on your behalf while trading securities on the exchanges. Brokers execute your buy/sell orders on the exchange for a fee or commission.

It is way easier today, much more so with online trading platforms, for any investor to trade stocks. Companies like Robinhood, E*TRADE, and Charles Schwab give you easy-to-use apps and websites from which you could buy or sell stocks right from your computer or smartphone.

Your broker will get in touch with the exchange to execute your buy/sell orders, following which the buyer or seller will be found. Then, a trade is done, and the stock is added to or removed from your account.

6. Stock Trading Types

Stock trading occurs in many forms, with its distinct strategy and time frame. Let us consider a few of the common categories:

A. Day Trading

Day trading involves the buying and selling of stocks within one day. It is when the day trader looks to make a profit from several trades during a single day due to short-term fluctuation in prices. The decisions of the day trader are based on technical analysis, which is simply looking at graphs regarding prices and patterns to study them in order to project future movements.

Although day trading is quite a risky venture, it may also prove to be thrilling and quick. Since the prices may change fast, so day traders must be fast and decisive, too. It is quite common for day traders to lose money in case they make the wrong call or the market moves against them.

B. Swing Trading

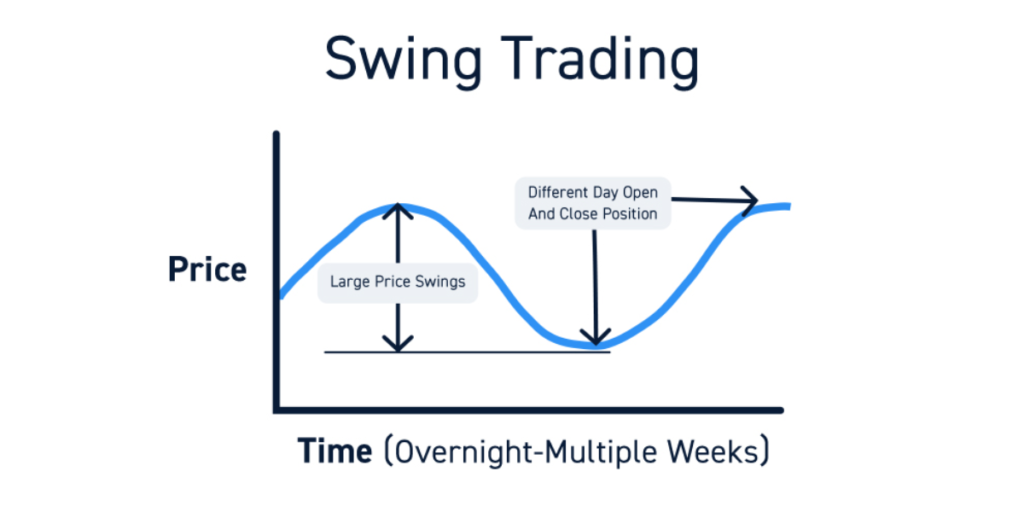

One of the medium-term strategies involves swing trading, whereby traders hold onto stocks for a period of days or even weeks. The idea is to capture the “swings” in the stock’s price, which are upward or downward movements over time.

The former uses a combination of technical analysis and fundamental analysis—that is, studying the financial health of a company and its market position—to make decisions. It requires less time and attention compared to day trading, hence suitable for people who cannot monitor the markets all day.

Read More :- Master Swing Trading: Essential Strategies and Stocks

C. Long-Term Investing

Long-term investing is a strategy most people term “buy and hold”. This means buying stocks with the intention to hold them for years, if not decades. It is based on the premise that well-chosen equities will appreciate over time and that the market will, in general, rise.

Long-term investors are more concerned about the general health and growth prospects of companies that they invest in. They may buy blue-chip stocks, a class of investment into solid business companies having a past record of stable development. One of the most famous exponents of such an approach was Warren Buffett, one of the greatest investors of all time.

Long-term investing requires a great deal of patience and self-discipline but is very rewarding. It is less stressful compared with short-term trading and minimizes the effect from fluctuations occurring every day in the market.

D. Dividend Investing

Dividend investing refers to an investment strategy that revolves around the purchase of dividend-paying stocks—issuers who declare cash payments to their owners. The mode of these payments is normally affected quarterly, although they hail from the company profits.

As such, dividend investors are not so concerned about the short-term price movements and more with generating an income stream that remains constant. The majority of dividend-paying stocks are shares in firms that are well-established, stable, and can afford sharing their profits with shareholders.

Due to the power of compounding, reinvesting dividends can result in a sizable buildup of wealth over time. It is for this reason that this kind of investment is favored by retired people and those who just want a more conservative investment approach.

7. How to Start Trading in Stocks

If you are interested in trading stocks, here is how you can get started in simple steps:

A. Educate Yourself

First and foremost, it is paramount to learn how to trade the stock market. Information today comes easy, from books and online courses, webinars, YouTube tutorials, discussion forums, Study trading strategies, risk management, and factors that influence prices of shares.

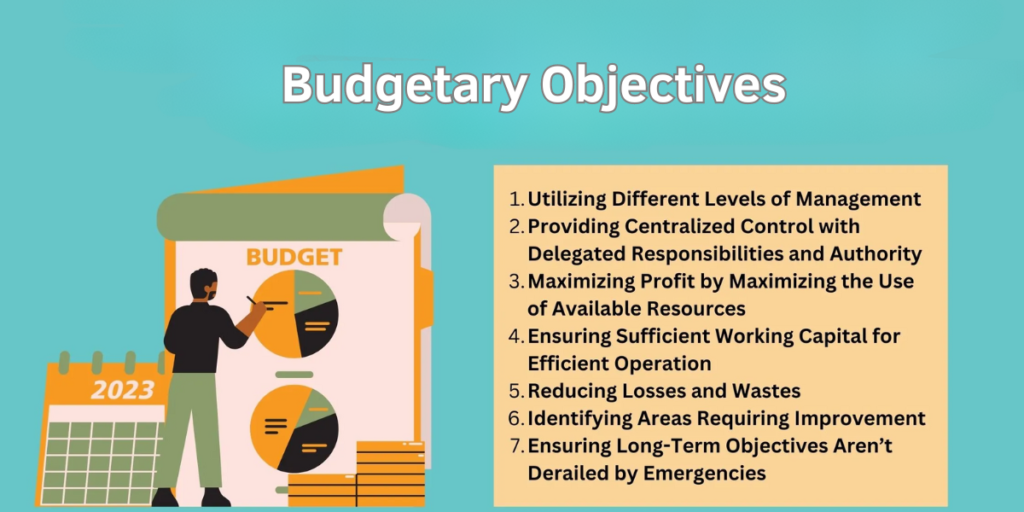

B. Set up budgetary objectives

What do you want to achieve with trading in stocks? Which would you rather prefer: creating passive income, accumulating long-term wealth, or indulging in some short-term trading? Your financial goals will guide your trading approach and the kind of stocks you should buy.

C. Develop a budget.

Only invest the money you can afford to lose. There is always a risk of losing all your money in the stock market, which at times gets very unpredictable. Now, set a budget in which you feel comfortable in the beginning, and never invest more cash than is needful for basics.

D. Choose a broker

Choose a good, reliable broker that will suit your needs. So what should you consider? Well, the things you need to check here are, of course, costs, trading tools, customer support, and, needless to say, user-friendliness of a trading platform. Brokers usually have demo accounts where you can practice trading with fake money before risking your real ones.

E. Start small

Dip your feet into the market, so to speak, with a small investment. You could then increase the amount you wish to invest based on learning and self-confidence. Remember, it is always better to start small and learn your lessons from mistakes than start big and lose everything.

Read More :- Intraday Trading: Effective Techniques for Success, Intraday Trading Strategy: Simple Tips for Beginners

F. Keep tabs on your financial investment

Keep track of your investments, but do not lose sleep over day-to-day market ups and downs. While short-term traders may be wise to take a closer look more frequently, long-term investors should, perhaps, assess their portfolios at regular intervals.

G. Increase Portfolio Diversification

It is always advisable not to put all your eggs into one basket. Spreading the assets across more than one equity, sector, or even asset class reduces the risk by diversification. If one stock in a portfolio performs poorly, the loss may be compensated by other good performances.

H. Keep Informing Yourself

The stock market responds to the variety of information that comes in the form of corporate news, political happenings, and economic statistics. Staying current with financial news, following the market, and knowing what is happening in your businesses are all part of being an educated investor.

Risks of Trading Stocks

Every investment has both risks and rewards when it comes to trading stocks. Knowing what both are before you get started can make a huge difference.

Market Risk: Stock prices tend to be very volatile. The value of a stock sometimes changes very quickly because of news, economic data, or investor sentiment. The investment is always at risk for losing some or even all of its value, mainly in the short run.

Company Risk: The bottom line of what one has invested in is the company’s underlying success. If a company runs into financial trouble, scandal, or mismanagement, the price of its stock can fall.

Liquidity Risk: Some stocks are hard to sell quickly without taking a loss, mainly illiquid stocks not traded much

Conclusion

Trading in stocks offers a great opportunity to be part of the financial markets and potentially be able to grow your wealth. Whether one is interested in short-term trading or investing for the long haul, understanding the basics is extremely relevant for making decisions that are well-grounded.

Just remember that trading is not about making fast money but about making a strategy in support of your financial goals, risk tolerance, and way of life. The stock market resembles more of a mischievous monkey. But with proper education, careful planning, and the right attitude, one can find keys that will give a leading edge in the market shake. Start small, learn on the go, and always be informed. By so doing, you’ll not only increase your chances of success but enjoy the journey of growing as an investor.