When it comes to strategies in investing in stocks, many are there, but none has stood the test of time quite as effectively as value investing. This approach-which was famously popularized by legendary investors such as Warren Buffett and Benjamin Graham, who both utilized this approach in order to achieve stellar success-brings into question: what is value investing, and just how can it be applied in stock trading? In this blog, we will break it down in simple terms-the very foundation of value investing-so you can start building your route to wealth.

Table of Contents

1. What is Value Investing?

Fundamentally, value investing is where an investor finds those stocks that have undervalued their prices in the market. In other words, value investors are on the lookout for companies whose stock prices are lower than what they perceive the company’s actual worth. In effect, what this leads to is that in due course of time, the market realizes the value of these stocks and their price increases so that the investor can gain a profit.

Value investing has been described variously as buying on sale. Consider going to the store and looking for shoes and finding a great pair that usually sells for twice as much as some sale price. If you knew they were selling for half of what they were worth, you’d probably think that was a really good deal. Similarly in this vein, value investors seek to find “deals” in the stock market by buying shares in good companies at a discounted price.

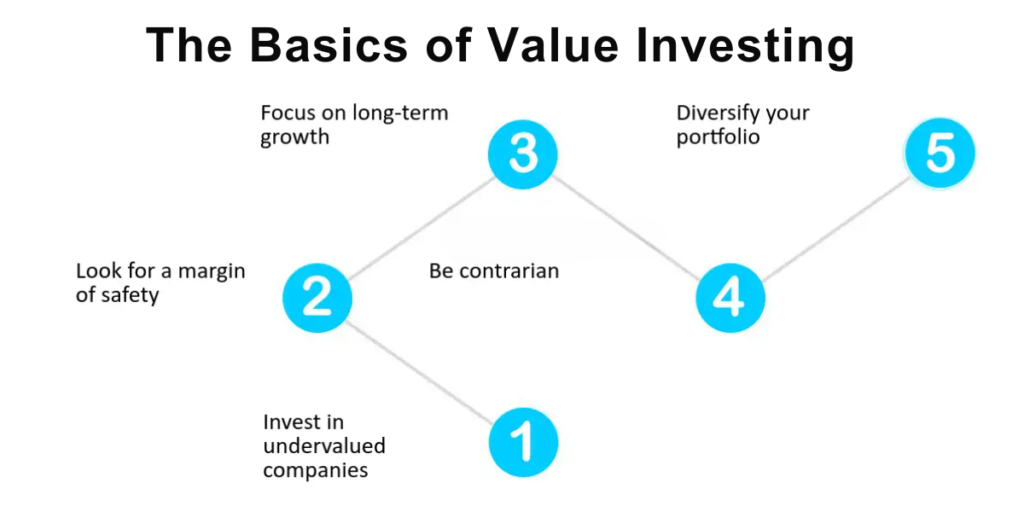

2. The Basics of Value Investing

If you want to be a successful value investor, there are a few things you need to know. Let’s delve a little into some basic entities:

A. Intrinsic Value

At the heart of value investing lies the concept of intrinsic value. Intrinsic value refers to the real value of a company derived from a set of fundamentals in the forms of earnings, dividends, and growth potentials, amongst others. This is an estimate of what the company is really worth, irrespective of whatever the market may say.

Financial statements and valuation models, like the DCF analysis, which estimates a present value of future cash flows from a company, are often used to compute intrinsic value. Although such calculations could be cumbersome and puzzling, the essence is to know whether the price of a stock is below its intrinsic value-a probable buying opportunity.

B. Margin of Safety

The margin of safety is another key cornerstone in value investing. This investing principle concerns buying stocks at a price significantly less than their intrinsic value. The investor consequently creates for himself a buffer or “margin” against errors in the analysis or unexpected market events.

For example, if you think some stock is intrinsically worth $100 per share and the stock is now selling for $70, then you have a margin of safety of $30. That gives you some degree of protection if it turns out you have become overoptimistic in your valuation or if the market as a whole takes a tumble.

C. Long-Term Orientation

Value investing does not offer a quick way to wealth. Instead, it calls for a rather long-suffering approach: if the market is highly unpredictable in the short term, a value investor may patiently wait until the market catches up with the stock’s real value, which might take several months or even years.

Perhaps the most renowned value investor, Warren Buffett, once said, “Our favorite holding period is forever.” Without meaning that one should never sell a stock, this does say much about being patient and letting investments grow over time.

3. How to Identify Value Stocks

Identifying value stocks is a mix of research, analysis, and intuition. Some steps can be followed in trying to find potential value investments. These steps include:

A. Search for Undervalued Companies

Start by screening for companies with low price-to-earnings ratios relative to their peers or the overall market. A low P/E ratio could indicate that the stock is undervalued, but it’s not the only metric you want to consider. Find low price-to-book ratios too, in which the underlying company’s market value is compared against the book value of the company, represented as the total assets less the liabilities.

B. Analyze Financial Statements

To gain more depth in understanding the real value of the company, research its financial statements, which include a balance sheet, an income statement, and a cash flow statement. Look at revenue growth, profit margins, levels of debt, and cash flow. A strong balance sheet with manageable debt and healthy cash flow will point toward good financial health for the company.

C. Understand the Business Model

Understand how the company makes its money before investing. What are its main products or services? Who is its competition? What are its growth prospects? Understanding its business model will help in making informed decisions as to whether the company enjoys a sustainable competitive advantage, so essential for long-term success.

E. Consider the Management Team

After all, a good management team means partly successful business. Look for experienced leaders who have consistently shown their ability to make prudent decisions to increase shareholder value. Go through annual reports, listen to earnings calls, and follow news stories about the company as a way to get a sense of the capabilities and vision of the management team.

4. Pitfalls to Avoid

While value investing can be an incredibly powerful strategy, it is not without its risks. Following are some common pitfalls to watch out for:

A. Falling for Value Traps

A value trap is a situation where a stock looks cheap on conventional metrics, such as the P/E ratio, but is actually inexpensive for a good reason-a declining business prospects or second-rate management, for instance. In avoiding value traps, research and think of the company’s prospects over the long run before deciding on investment.

B. Ignoring Market Sentiment

While value investors are focused on the fundamental analysis of companies, one should not completely discard the notion of market sentiment. This is because even a fundamentally strong company may very well face a loss in the stock price if there is negative sentiment regarding its industry or general market. Keep up with the market trends and news, but don’t let short-term movements send your investment decisions sideways.

C. Overestimating Your Abilities

Investing in undervalued stocks requires profound knowledge of financial analysis and market dynamics. Be honest about your knowledge and skills, and considering seeking advice from a financial advisor or professional research services to help make informed decisions.

Read More :- Margin Trading: What It Is and How It Can Impact Your Portfolio

5. The Advantages of Value Investing

Despite the challenges that come with it, value investing does have a number of advantages, which make it an attractive strategy to many investors. Key benefits of value investing include the following:

A. Lower Risk

Through investment in undervalued stocks with a margin of safety, value investors seek to minimize their chances of loss. While no investment is completely risk-free, purchasing stocks at a discount may give some protection against market volatility and eventual downturns.

B. Potential for High Returns

Historically, value investing has provided good returns, especially in the long term. Through recognizing the mispriced securities, the value investor may gain huge profit when the market finally corrects its mistake and the stock reflects its true worth.

C. Fundamental Focusing

Value investing focuses much on fundamental analysis, having deep knowledge about the financials, business model, and management of a company. This would assist in better and more knowledgeable decisions about investment, and thus probably be successful in the long term.

6. Getting Started with Value Investing

Value investing is an exciting strategy for investors. It all starts with the following steps:

A. Educate Yourself

Read books on value investing, join and complete some online courses on the subject, and generally follow reputable financial news. Classics to consider reading include “The Intelligent Investor” by Benjamin Graham and “Common Stocks and Uncommon Profits” by Philip Fisher.

B. Start Small

As with any investment strategy, it is wise to start small and gradually increase your exposure as you build experience and confidence. Consider opening a brokerage account and starting with a small portion of your portfolio dedicated to value stocks.

C. Stay Disciplined

Value investing requires discipline and patience to stick with a strategy through extremely volatile markets or when stocks are not performing well in the near term. Remember, after all, you want to invest in companies with sound fundamentals and that are trading at a discount, not to chase some ephemeral gains.

D. Diversify Your Portfolio

Value investing is rewarding, but on the other hand, it is not a prudent thing to place all your eggs in one basket. Diversifying a portfolio through a mix of value stocks, growth stocks, bonds, and other asset classes becomes vital if one is thinking of reducing risks and giving oneself a better chance at long-term success.

Read More:- How to Use Stop-Loss Orders to Protect Your Investments

Conclusion

Value investing is one of the time-tested strategies that have assisted scores of investors in accumulating wealth in the long run. If some attention is paid to undervalued stocks with a strong fundamental basis, it will help a value investor reduce risks and heighten his or her possibility of securing high returns. Though it demands patience, discipline, and a willingness to do your homework, the rewards could well be worth all that effort. So, if ready, well and fine-tune your value investing odyssey right now. Happy investing!

Operating on these precepts and pledging yourself to this strategy will get you well on your way to success as a value investor. Remember, investing is a marathon, not a sprint, and what is most important is to keep yourself informed and to make decisions based upon sound analysis and research.