The idea of investing in the stock market can be very intimidating, especially with terms being thrown around like “value investing vs growth investing.” Both methods are normally considered complete opposites but can yield extremely profitable results when taken advantage of correctly. But which is best? In this blog post, we will break down what exactly value investing vs growth investing are, the pros and cons of each, and help you figure out what approach might suit you best.

Table of Contents

1. What is Value Investing?

Value investing is similar to bargain shopping. Investors who follow this strategy look for those stocks that they feel have been sold for less than their intrinsic values. They are looking for companies whose stock prices at the moment do not reflect the company’s actual value due to some short-term setbacks or overreaction of the market. The goal of such an investor then is to buy these “bargain” stocks and hold onto them until the market finally recognizes their value-that is, until the price of those stocks rises accordingly.

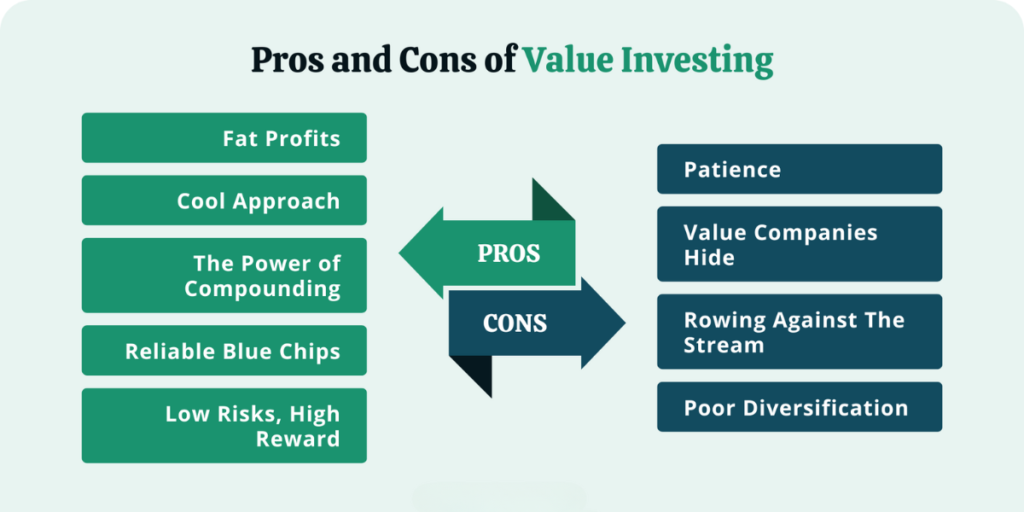

2. Value Investing Advantages

A. Purchasing at a discount: The biggest advantage one gets by using value investing is value for money since one is buying stocks at a cheaper price than their actual worth.

B. Less volatility: Value stocks are usually from well-established companies; hence, these stocks are less volatile than growth stocks.

Dividends: Most value companies pay dividends, thereby ensuring one reaps in some income while waiting for the appreciation of the stock price.

3. Risks of Value Investing

A. Patience is required: Ordinarily, value stocks don’t see sharp rises in prices, so one is bound to hold them for some time before great returns kick in.

B. The value trap: Sometimes, a stock is cheap for a reason. The company’s poor financials or business challenges could mean the price will stay low and trap your money.

C. Market sentiment: It may take longer than expected for the market to recognize the value of a stock, or worse, never recognize it at all.

Read More :- Value Investing : A Simple Guide to Building Wealth

4. What Is Growth Investing?

Growth investing is the glossy new toy of investment. The investors following this approach look for those firms that are growing fast and will continue with an outstanding earnings in future. These companies, normally these are those firms which place profits back into the business for additional growth, hardly ever pay dividends.

5. Advantages of Growth Investing

A. Higher potential returns: By their very nature, growth stocks must rise in value quickly. This means you can potentially make quite substantial returns in a relatively short space of time.

B. Innovation and disruption: Growth companies often form part of new technologies or industries. For the investor looking to be part of the next big thing, this may be quite exciting.

C. Riding on the wave of expansion: While expanding into newer markets or coming up with innovative products, the businesses can grow their earnings and stock prices at an exponential rate.

6. Risks of Growth Investing

A. High volatility: Growth stocks highly volatile. The stock price of a company might sometimes drastically swing in response to earnings reports, news, or even market speculation.

B. Overvaluation: Growth stocks are often priced according to prospective earnings, meaning they can be overvalued. When the company doesn’t live up to such growth, the stock price tumbles.

C. No dividends: Most growth companies don’t pay dividends; that means all your returns depend on the stock price rising.

Read More :- The Fundamentals of Growth Investing in the Stock Market

7. Comparing Value Investing vs Growth Investing

| Aspect | Value Investing | Growth Investing |

| Focus | Buying undervalued stocks | Investing in companies with high growth potential |

| Risk Level | Typically lower | Typically higher |

| Time Horizon | Long-term holding | Medium to long-term, with potential for faster gains |

| Dividends | Often pays dividends | Rarely pays dividends |

| Volatility | Generally lower volatility | Higher volatility |

| Potential Returns | Moderate, with slower appreciation | Higher, but with more risk |

| Best for | Conservative, patient investors | Risk-tolerant, future-focused investors |

8. Which Strategy is Right for You?

Determining between value investing and growth investing depends on quite a few factors, including your financial goals, how much risk you are willing to take on, and your time frame for investing.

Consider Value Investing If:

You prefer stability over excitement: If you want to achieve gradual and steady returns and do not worry about big, fast profits, then value investing may be for you.

A. You are a patient investor: Value investing takes time. If you can sit tight with stocks for many years, waiting for the market to catch up with their intrinsic value, then this could be the way to go for you.

B. You want dividends: Many value stocks allow dividends, and with those come regular income opportunities for you as you wait for the appreciation of the stock price.

Consider Growth Investing If:

You’re willing to take a bit more risk for potentially higher rewards: Growth investing does carry some more risk, but if you are one who can stomach volatility for the possibility of a bigger pay-off, this could be your route.

A. You believe in innovation and the future: Growth investing is often a bet on companies that are pushing the envelope of technology or industry. If the idea of investing in the next big thing excites you, growth stocks may be a good fit.

B. You take a long-term view: While growth stocks enjoy more rapid price appreciation, they are best for investors with a somewhat long-term orientation and those who can ride the ups and downs in the market.

9. Can You Do Both?

The beauty of investing is that you do not necessarily have to pick one strategy. Indeed, many investors create a diversified portfolio of both value and growth stocks. You can achieve some security due to the stability of the value stocks while reaping high returns from growth stocks.

Conclusion

Both value investing and growth investing are contrasting approaches; however, both hold merits. Which to choose depends on one’s personal investment style, goals, and acceptable risk level. If you are that type of investor who loves the thrill of high-pacing companies with ups and downs, then growth investing might be your cup of tea. On the other hand, in case you are comfortable with conservative prospects with chances of steady returns, then maybe it is the path of value investing for you.

In reality, an approach that combines elements of both may be able to provide a little bit of both worlds in terms of balancing risk and reward. Whichever you choose, the secret to success lies in education and staying on course. Happy investing!